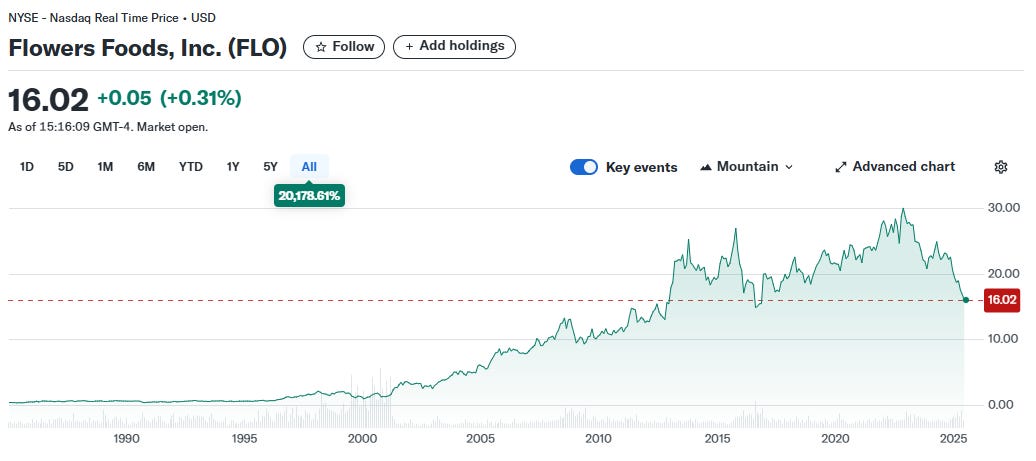

In the world of investing, few sectors appear as steady and dependable as consumer staples. People will always need to eat, and for over a century, Flowers Foods (NYSE: FLO) has been there to put bread on their tables. As one of the largest producers of packaged bakery foods in the United States, with annual sales of $5.1 billion and a network of 44 bakeries, this is a company built on a foundation of household names and daily consumption. Yet, a glance at its recent stock performance tells a story not of stability, but of significant investor anxiety. The share price has crumbled, touching a 52-week low and leaving many to wonder if this is a temporary dip or the beginning of a structural decline.

The immediate catalyst for this pessimism was a disappointing first-quarter earnings report for 2025, which saw both revenues and profits miss expectations. However, the market's reaction feels disproportionate to a single bad quarter. It points towards a deeper unease, a fear that the very bedrock of Flowers' business is being eroded by the shifting sands of consumer preference. CEO Ryals McMullian has himself acknowledged the pressures, citing a challenging economic environment, the rise of weight-loss drugs like GLP-1s, and a broad trend towards healthier eating as potential culprits for the weakness. In response, management has charted a course for reinvention under the banner 'Fresh. Forward. Flowers.', an ambitious plan to become a more agile, insights-driven company. The central question for any potential investor, therefore, is whether this forward-looking strategy can successfully navigate the present storm. Is Flowers Foods a stale investment, destined to be left on the shelf, or is it transforming itself into a star baker for the future?

A Portfolio of Two Halves

To understand the challenge facing Flowers Foods, one must first look inside its brand pantry. The company is, in effect, running two distinct businesses under one corporate roof. On one side, you have the old guard: the iconic, nostalgic brands that built the company and remain household names. Brands like Wonder Bread, Sunbeam, and the snack cake purveyor Tastykake are deeply woven into the American cultural fabric. These are high-volume, cash-generating machines with immense brand awareness. However, they operate in categories that are facing serious secular headwinds. The recent results lay this bare, with management pointing to "significant weakness in the sweet baked goods category" and persistent pressure on traditional loaf products as a major drag on performance. These brands are the company's past and, for now, its present cash cow.

On the other side of the aisle is the new guard, a collection of premium, on-trend brands that represent the company's future. This strategic pivot began in earnest with acquisitions like Dave's Killer Bread (DKB) in 2015 and Canyon Bakehouse in 2018. DKB is not just a niche player; it is the number one organic bread brand in the country, a powerhouse that recently surpassed $1 billion in annual retail sales. Canyon Bakehouse, meanwhile, has given Flowers a commanding position in the burgeoning gluten-free market. These brands are thriving, gaining market share in the very "specialty premium" segments of the grocery store where consumers are still willing to spend. In 2023, these organic and gluten-free lines already accounted for over 17% of sales dollars, a figure that is clearly set to grow.

This internal dichotomy creates a fascinating management challenge. The core task for the leadership team, led by Chairman and CEO Ryals McMullian, is to skilfully manage a strategic transition. They must use the steady, albeit declining, cash flow from the legacy brands to fund the investment-hungry growth of the premium portfolio. This is a delicate balancing act. Starve the old guard of resources too quickly, and the cash flow needed for investment dries up. Fail to invest aggressively enough in the new guard, and the company risks being outpaced by more nimble competitors. It is within this context that the company made its most audacious move to date, a move designed to decisively tip the scales towards its future.

Latest Results

The first quarter of 2025 provided a stark illustration of the pressures Flowers Foods is currently under. The headline figures were undeniably weak. Net sales slipped by 1.4% to $1.554 billion, while net income took a much harder fall, plummeting 27.4% to just $53.0 million. On an adjusted basis, which smooths out one-off costs, earnings per share fell to $0.35, down from $0.38 in the same period last year.

Digging into the details reveals a worrying combination of factors. The sales decline was not merely a function of pricing; it was driven by a fundamental drop in demand. Overall volumes fell by 2.7%, a decline so significant that it overwhelmed the modest 1.6% sales contribution from the company's latest acquisition. This indicates that the core, organic business is shrinking at a concerning pace. Management was candid about the cause, attributing the poor performance to "weaker than expected category trends" across the board. The data supports this, with industry-wide unit sales for the bread category falling 2.4% and, more alarmingly, the cake category collapsing by 6.4%. While this shows Flowers is not alone in its struggles, it highlights the difficult environment it must operate in.

The profit picture is equally complex. There was a silver lining in the form of moderating ingredient costs, which helped improve production cost margins by 50 basis points. In a normal environment, this would have flowed through to the bottom line. However, this benefit was completely erased by a 110 basis point surge in Selling, Distribution, and Administrative (SD&A) expenses. This increase was attributed to higher costs related to the workforce and, crucially, the integration of its new acquisition. The company appears to be running harder just to stand still, with efficiency gains at the factory level being consumed by the rising costs of selling its products and integrating new businesses.

Perhaps the most telling signal from the report was the decision to lower financial guidance for the full year. Management cut its forecasts for net sales, adjusted EBITDA, and adjusted earnings per share, a clear admission that the headwinds encountered in the first quarter are not expected to abate any time soon. The results paint a picture of a company grappling with a fundamental demand problem in its core markets, forcing it into a more promotional stance while simultaneously trying to absorb the costs of a transformative acquisition.

The $795 Million Bet on Better-For-You Snacking

In February 2025, Flowers Foods completed the largest acquisition in its 105-year history, paying $795 million in cash, for Simple Mills. This was not a minor bolt-on; it was a definitive, company-altering bet on the future of food. Simple Mills is a market leader in the "better-for-you" space, offering a range of premium crackers, cookies, snack bars, and baking mixes made with simple, nutrient-dense ingredients. With strong growth, a loyal consumer base, and distribution in over 30,000 stores, it is exactly the kind of brand that Flowers needs more of.

The strategic rationale is crystal clear. Management aims to accelerate its pivot away from traditional bread, diversifying into the higher-growth, higher-margin snacking segment. The deal immediately increases the proportion of sales from branded retail to approximately 66% of the company's total, and it provides a powerful new platform to compete for the health-conscious consumer. The plan is to leverage Flowers' formidable distribution network and operational expertise to accelerate Simple Mills' already impressive growth, which saw a compound annual growth rate of 28% between 2019 and 2024.

However, this transformation comes at a significant price. The entire acquisition was funded with debt, causing pro-forma net debt to swell to around $1.9 billion and pushing the company's leverage ratio to approximately 3.5 times its annual EBITDA. This move was significant enough to prompt the credit rating agency S&P Global Ratings to revise its outlook on Flowers' debt from stable to negative, citing the increased financial risk. Furthermore, the deal is expected to be dilutive to earnings in its first year, reducing adjusted earnings per share in 2025 by an estimated $0.07 to $0.08.

This is a classic case of sacrificing short-term certainty for long-term potential. The company is consciously weakening its balance sheet and near-term profitability in the hope of fundamentally reshaping its growth trajectory. Analysts have recognised this trade-off, generally viewing the deal as strategically sound but fraught with risk. S&P noted that Flowers has limited experience in the hyper-competitive cookie and cracker categories, which are dominated by global giants like Mondelez and Kellanova. This introduces significant execution risk. On the other hand, many also point to Flowers' excellent track record of successfully integrating and growing acquired brands, most notably DKB and Canyon Bakehouse, as a reason for optimism. Ultimately, the Simple Mills acquisition is a high-stakes gamble. Its success or failure will likely be the single biggest determinant of shareholder returns for the next five years.

The Headwinds and the Possibility of Recovery

The challenges facing Flowers Foods are not happening in a vacuum; they are part of a broader shift in the entire bakery industry. The primary headwind is the evolution of the consumer. A secular trend towards healthier eating, concerns about processed foods, and even the recent popularity of GLP-1 weight-loss drugs are all conspiring to reduce demand for the company's traditional products like white bread and sugary snack cakes. As CEO Ryals McMullian noted, the "middle" of the market is getting squeezed, as consumers either trade up to premium, differentiated products or trade down to private-label value offerings.

Compounding this demand issue is the persistent threat of commodity price volatility. While the cost of key ingredients like wheat and oils has moderated recently, providing some margin relief, management has warned of potential headwinds returning in the second half of 2025. Finally, the competitive landscape is fierce. Flowers is the number two player in US packaged bakery, but it operates in the shadow of the much larger global entity Grupo Bimbo. Its expansion into snacking with Simple Mills now pits it directly against behemoths like Conagra and Kellanova.

In response, management has formulated a multi-pronged recovery plan that goes beyond just acquisitions. A key focus is on portfolio optimisation and cost efficiency. This involves tough decisions, such as the closure of an underperforming bakery in the first quarter of 2025, as well as initiatives to reduce production scrap and streamline the company's vast transportation network. The savings generated from these actions are being redeployed into targeted innovation and brand support.

This innovation is not random; it is aimed squarely at the identified pockets of growth. The company has aggressively pushed into the keto sub-category with its Nature's Own line and was recently rewarded by capturing the number one market share position for the first time. It is also launching new sourdough products and, in a nod to value-conscious shoppers, expanding its line of smaller loaves to appeal to smaller households and reduce food waste. This strategy reveals the delicate balancing act management is attempting. They are simultaneously trying to cater to the premium, health-conscious consumer with brands like DKB and Simple Mills, while also addressing the value-seeking consumer with smaller pack sizes. The risk is that by trying to be all things to all people, they could fail to excel in either arena. The coming quarters will reveal if this strategic straddling is a masterstroke of market segmentation or a dilution of focus.

Valuation and Dividends

After dissecting the strategy, the portfolio, and the recent performance, the ultimate question is whether Flowers Foods stock represents good value. The market's recent verdict has been harsh, pushing the stock down to a P/E ratio of around 13.7 times trailing earnings and near its 52-week low. As the table below illustrates, this valuation is attractive relative to some of its large-cap packaged food peers.

The stock is clearly not expensive on a historical basis, but the bear case is that it is a classic "value trap," a company that looks cheap for the very good reason that its core business is in a managed decline. This is where the company's dividend policy becomes a critical piece of evidence. Flowers Foods has an impeccable record of rewarding its shareholders, having paid 91 consecutive quarterly dividends.

What is most telling, however, is not the history but the timing of the most recent increase. In May 2025, after the weak first-quarter results were announced and after the company had taken on nearly a billion dollars in debt to buy Simple Mills, the board of directors approved a 3.1% increase in the quarterly dividend. In the announcement, CEO Ryals McMullian explicitly stated the move "reflects the board's confidence in Flowers' strategy and ability to enhance shareholder value over time".

This action provides a powerful counter-narrative to the market's pessimism. A board, with its fiduciary duty to shareholders, would be highly unlikely to authorise a dividend increase if it believed the company's future cash flows were in jeopardy. Despite the drop in reported net income, the company's cash flow from operations actually improved significantly in the first quarter, rising to $135.6 million, which comfortably covered the $52.3 million paid out in dividends. This suggests that management's internal forecasts, which account for cost savings and the future contribution from Simple Mills, paint a much healthier picture than the headline earnings figures currently show. The dividend hike is management putting its money where its mouth is.

Interestingly insiders have also been buying shares in the company recently, signifying their confidence in the business’ recovery.

My Final Verdict

So, is Flowers Foods a stale loaf or a future star baker? The answer, like most things in investing, is nuanced.

The bear case is straightforward and compelling. The company's legacy brands, the historical engine of its profitability, are in categories facing a secular decline. To counter this, management has executed its largest-ever acquisition, funding it entirely with debt and taking on significant financial and execution risk by entering a new, highly competitive market. If the integration of Simple Mills falters, or if an economic downturn puts pressure on its ability to service its debt, the company could find itself in a very difficult position. In this scenario, the stock is a value trap, and the prized dividend could even come under threat.

The bull case, however, is equally persuasive. It posits that management is not reacting to change, but proactively shaping the company's future. They are astutely using the cash generated by the old business to fund a pivot into the fastest-growing, most profitable segments of the food industry. The acquisition of Simple Mills, while expensive, is a transformative move that will accelerate this transition and create a more resilient, higher-growth company for the long term. The board's confident dividend increase in the face of market panic is a powerful signal that the underlying cash flow of the business remains robust. From this perspective, the current depressed share price offers a rare opportunity to buy into a quality company at a low valuation, locking in a high and growing dividend yield while waiting for the market to appreciate the long-term strategy.

Ultimately, Flowers Foods appears to be an investment for the patient. The risks are real; the high leverage and the challenge of integrating Simple Mills cannot be dismissed. The next 18 to 24 months will be critical as the company works to digest its new prize and deleverage its balance sheet. For investors who demand immediate results or are unwilling to tolerate volatility, this may not be the right choice. However, for those with a multi-year time horizon, the combination of a low valuation, a bold strategic pivot into on-trend categories, and a well-covered, high-yield dividend, all backed by the tangible confidence of its management team, presents a compelling, if not entirely straightforward, investment case. The dough has been kneaded; now investors must wait to see if it will rise.

Thank you for reading, and have a great day!