Centene Corporation (Ticker: CNC) is a prominent American healthcare company specialising in government-sponsored and privately insured healthcare programs. Founded in 1984, the company has grown to become a significant player in the managed healthcare industry.

Centene generates revenue through multiple streams, with its core business revolving around government-sponsored health plans. The company contracts with state governments to manage Medicaid programs, receiving fixed payments per enrolee.

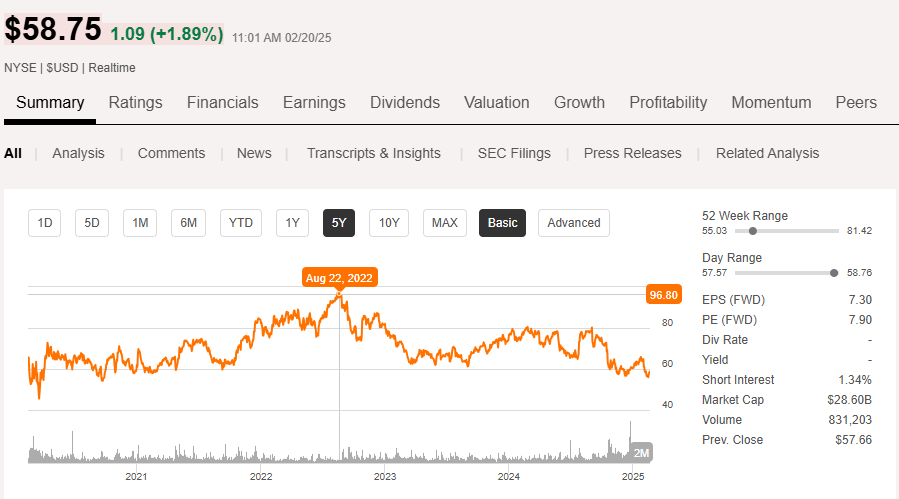

Shares in Centene have been moving downwards since 2022 now, down from it’s all-time high of around $97/share to about $58/share today. This has happened while the value of the business has grown dramatically, causing a large gap between price and value in my eyes.

Valuation today provides an attractive entry point, and today I will share why this is the case, and why I expect shares to start to turn around in 2025. However first we need to look at what has caused the decline in price over the past couple of years.

What Caused The Drop?

The largest reason for the decline was the end of the COVID-19 public health emergency in 2023. This triggered state-led Medicare eligibility reviews, potentially reducing enrolment by 10–15% (~2M members).

There has also been ongoing regulatory scrutiny, with audits and litigation risks being very real to the company. A $166M settlement over pharmacy pricing practices had to be paid in 2021 just as one example.

Centene also exited all the unprofitable ACA Marketplace markets in 2023, which placed a large headwind on short-term growth. This however will be a positive for the company long-term.

The upside to this is these are all temporary problems, and management has reaffirmed their long-term guidance, meaning they are confident in their ability to deal with these problems effectively and continue their growth. So let’s look at why the company could be a buy at current prices:

Why Buy Centene?

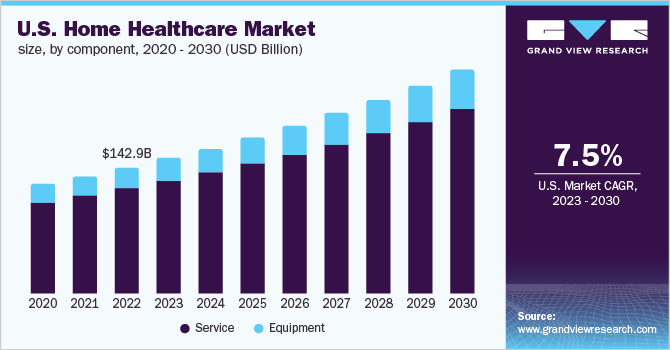

US Healthcare Market is Expanding

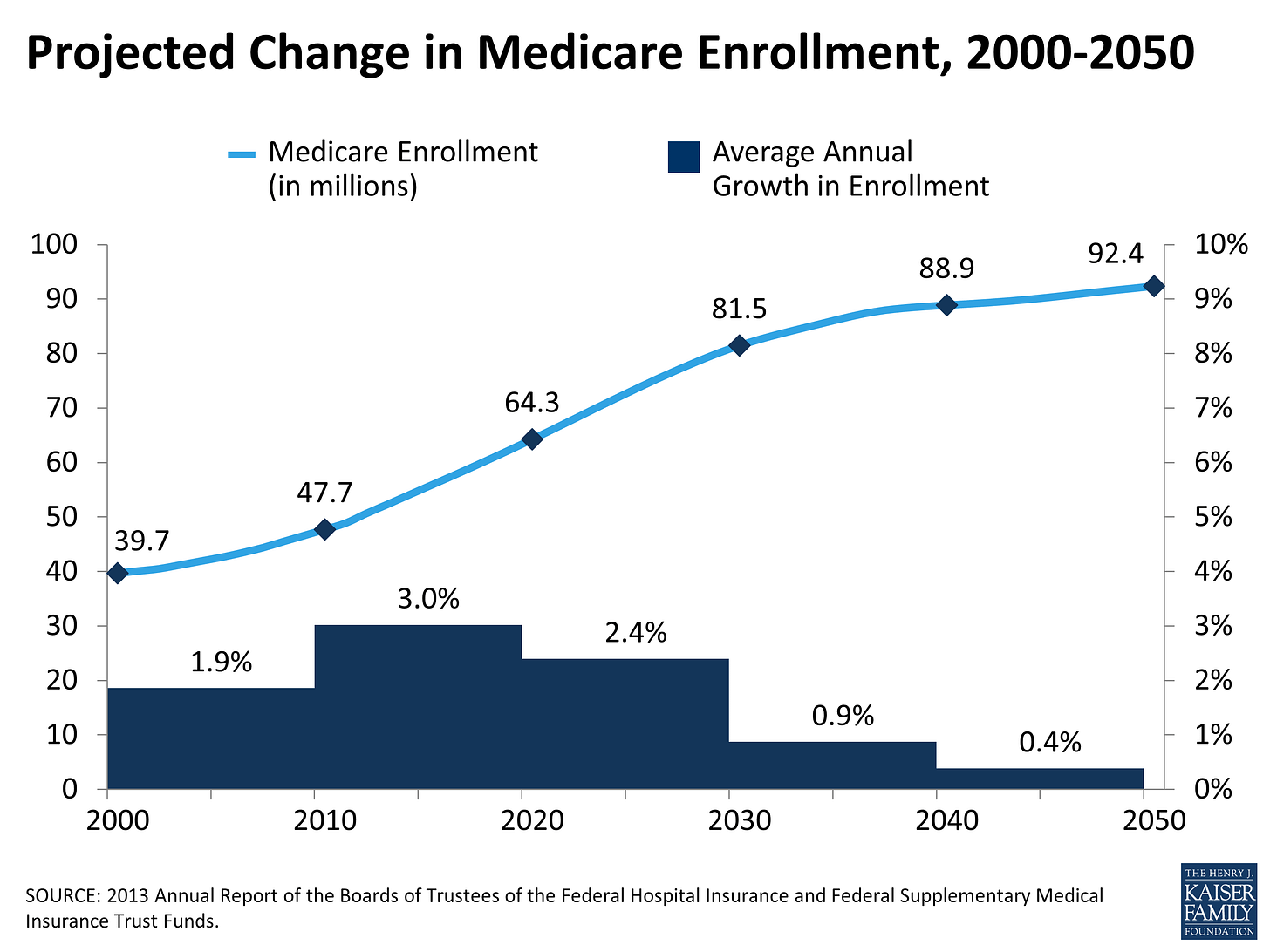

Structural Growth in Government Healthcare in the USA is a large tailwind for the company. Medicaid currently covers over 85M Americans, with expansion adopted by 40 states. Centene’s Medicaid footprint spans 31 states, meaning they are poised to benefit from growth.

Medicare Advantage enrolment is growing at 7% annually, with Centene aims to capture 5% market share by the end of 2025. With the ACA Marketplace stabilising, and with Centene covering 3.1M members, the future looks bright for Centene to grow over the next decade.

Improving Margins

Centene also has a large margin improvement initiative currently underway. They achieved $1.4B in annual cost savings in 2024 through operational efficiencies and tech investments. This is sure to continue into 2025, and with both revenue and margins growing, earnings is sure to grow quickly. They have also divested their non-core assets (Magellan Specialty Health and other international units) to create a greater focus within the company on the main business.

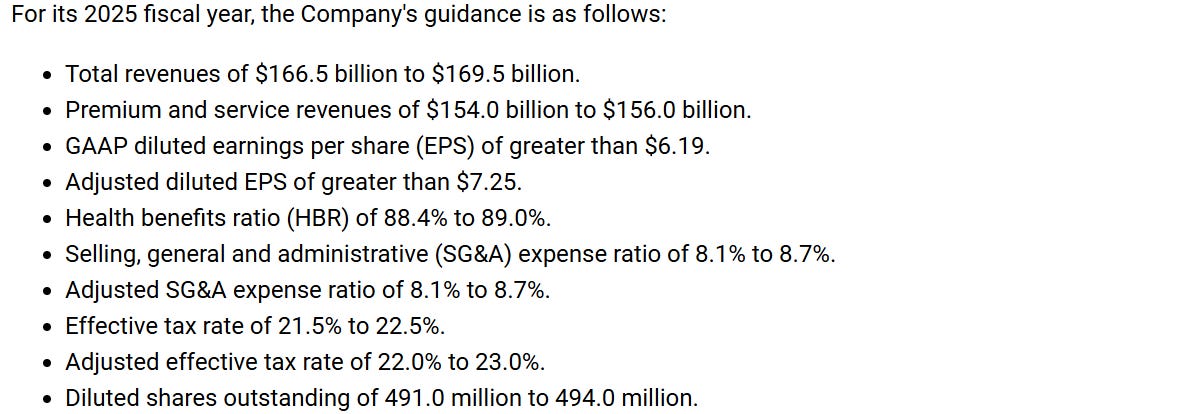

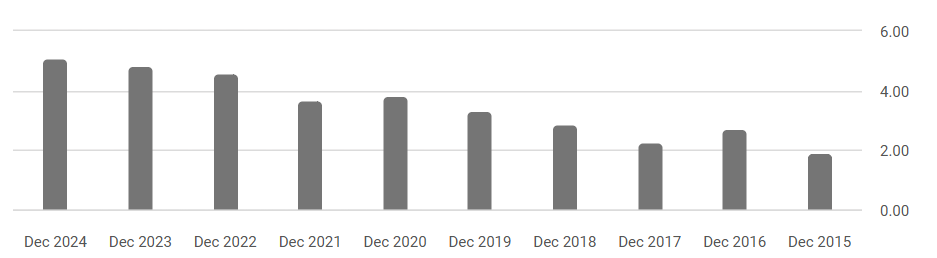

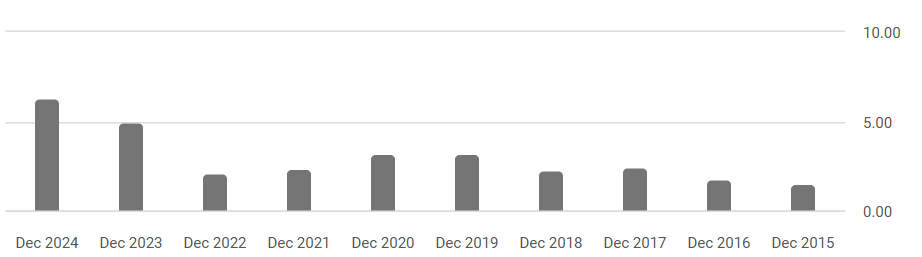

EPS Growth Potential

Centene's long-term outlook is strong. Management have previously expressed confidence in achieving 12% to 15% EPS growth in a normal environment. While this target is definitely ambitious (and is no reflected in the current share price), the preliminary 2025 Medicare Advantage revenue projection of $14 billion to $16 billion, while implying lower membership, indicates progress towards greater profitability in this segment.

According to the Congressional Budget Office. U.S. spending on Medicare is poised to grow from $1.0 trillion in 2023 to $1.6 billion by 2030. This reflects a 7% top line increase YoY, assuming that Centene can grow at the same pace as the rest of the industry. At the current valuation of around 8x earnings, Centene is being priced as a no-growth stock.

Looking at all of this the stock definitely looks undervalued at a P/E of only 8 - so lets look at the risks causing the valuation to be so cheap.

What are the Risks?

The largest risk facing Centene investors is its reliance on government-sponsored programmes and the vulnerability the company has to a single stroke of President Trump’s pen. The DOGE is keen to cut any ‘unnecessary’ spending and it may set its sights on Medicare.

Owning a stock which has exhibited high volatility lately can also be unappealing. The Beta is up from 0.47 over 24 months to 0.85 currently. Lacking a dividend when competitors pay also makes Centene appear too conservative. Most of Centene's competitors pay dividends, though the managed care industry is notorious for low payout ratios and yields. A company that recently reported a quarterly revenue of $40.81 billion can definitely afford to pay its investors a dividend.

At times, the company's operational costs can also exceed reimbursements hurting cash flow, eating away at profit margins, and requiring internal cost-cutting to reduce efficiencies.

The recent slowdown of growth is also certainly concerning - although management seems confident this will not be the long term trend. This still needs to be monitored closely, as management can say they will grow, but we will have to start seeing it in the numbers at some point to completely believe them.

So is it Time to Buy the Dip?

Centene is a financially sound, growing company in a recession-resistant industry. It also appears to be sufficiently undervalued to be bought with a large margin of safety. At today’s price of ~$57/Share, I rate the stock a buy.

Honestly I don’t understand why the company has been continuously dipping since 2022. It may be the market has simply forgotten it, not being a technology or AI company has certainly been a major disadvantage in recent years, and Centene seems to be a victim of recent ‘hype’ in the market.

When the bull run eventually ends and defensive sectors are rotated to the forefront of most people’s portfolios, I think Centene will be a big winner.

Thank you for reading, have an amazing day ☺️