Merck & Co. (Ticker: MRK) operates as a global healthcare company through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, vaccine products and adult vaccines.

The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digital identification, tracing, and monitoring products.

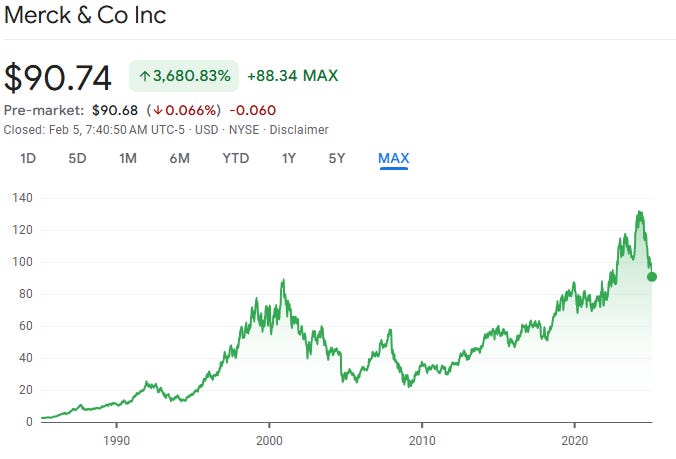

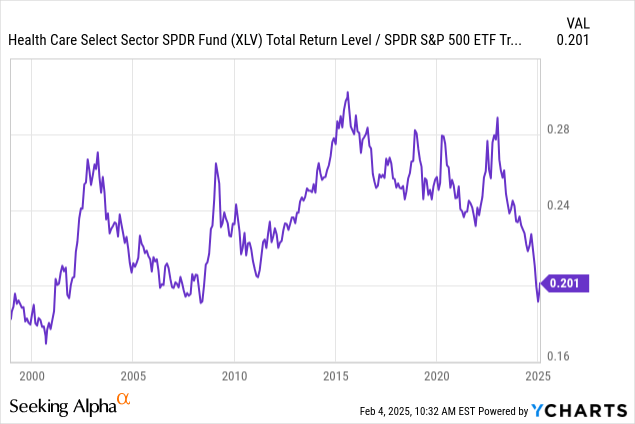

The company is down 32% from it’s highs last year, the largest sell off the company has had since 2009. To be fair, the healthcare industry as a whole has been underperforming the S&P500 massively over the last few years (as seen below).

The problems in the industry as a whole, as well as with Merck itself are greatly exaggerated in my opinion, and I think this stock is one of the most attractive to take advantage of the recent underperformance.

First let’s look at why the stock has sold off so much over the last year:

The Sell-Off:

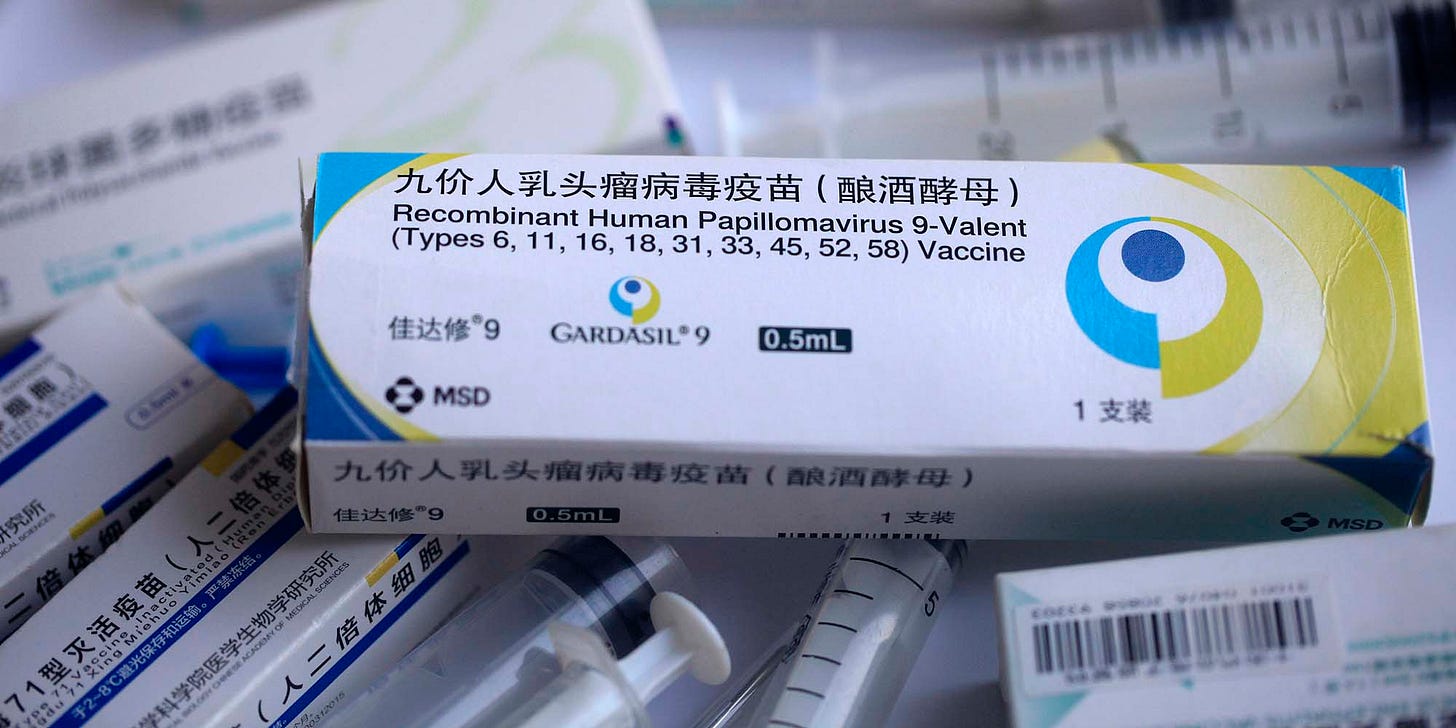

In it’s most recent earnings report, Merck issued underwhelming guidance for the next year, and we saw problems with the company’s Gardasil program, including a shipment pause to China. This caused an enormous 11% sell-off which seems like an overreaction to me.

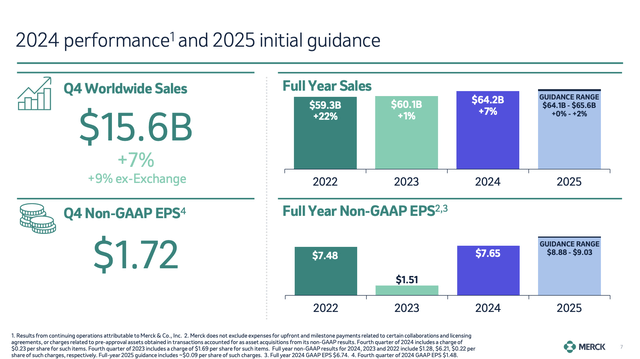

As we can see their sales were up 7% YoY, much better than the 1% growth in 2023. EPS also increased to $7.65, which is up from $1.51 in 2023, a large increase although it was large one-off payments which caused the massive decline in 2023’s EPS. What caused the sell off was the guidance for 2025. The company guided for sales between $64.1 billion and $65.5 billion for 2025, while the market expected $67.07 billion in sales.

Analysts also expected $9.13 in full-year EPS, while Merck said that it will be in the $8.88 - $9.03 range.

This large failure to meet guidance was due to the company's decision to pause shipments of Gardasil to China from February until at least June. This is the result of ongoing challenges facing it’s most successful vaccine in the massive Asian market. The good news is that the company still sees “strong growth” in 2H25, 2026, and the year after that, “irrespective of Gardasil in China.”

Merck has also faced challenges with some of it’s other products. Sales of it’s type 2 diabetes drug ‘Januvia’ fell 27% in 2024 from a year earlier due to lower demand, pricing pressures and generic competition across multiple markets.

The company’s reliance on its flagship drug ‘Keytruda’ also contributed to this decline. Although Keytruda sales increased by 16% YoY in the second quarter of 2024, the company’s reliance on just one drug was another cause for concern for investors.

These are all concerns for the company, but if we zoom out and look at the most likely long-term scenario, things look good for Merck:

The Opportunity:

Broadening Horizons

The company's upbeat Gardasil comments are backed by positive developments. The vaccine recently gained approval for use on males, which obviously doubles its target population and reinforces its long-term growth prospects in the Asia region.

One reason why the market is reacting so sensitively to the Gardasil news is that Merck is facing patent loss of its key drug, Keytruda, in 2028. In 4Q24 alone, this drug generated $7.8 Billion in sales, 21% more that 4Q23. This also marks the third consecutive year of greater than 20% growth, an extremely impressive number.

Strong Pipeline

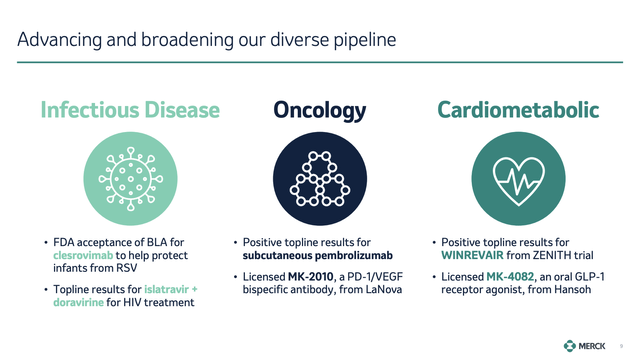

Like all of its peers who face patent losses, Merck is investing in its pipeline and rolling out new products to soften patent loss risks.

Merck said in the most recent earnings call that they see positive tailwinds in the near future. These include the FDA's approval of Clesrovimab, an antibody designed to protect infants from RSV (Respiratory Syncytial Virus), and positive trial results for a more convenient administration method for cancer patients.

The company's HIV treatment portfolio also saw progress, and they saw positive outcomes in the ZENITH trial for their pulmonary arterial hypertension drug.

Due to all of these efforts, the company has around 20 potential blockbuster drugs and tripled it’s late-stage developments over the past three years. This pipeline offers $50 Billion in potential annual sales. While we still don’t know how many of these drugs will make it to the market, it's certainly a good foundation for the next few years.

Dedication to Rewarding Shareholders

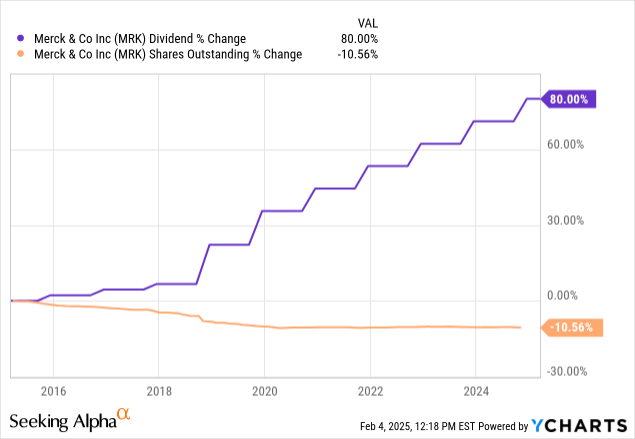

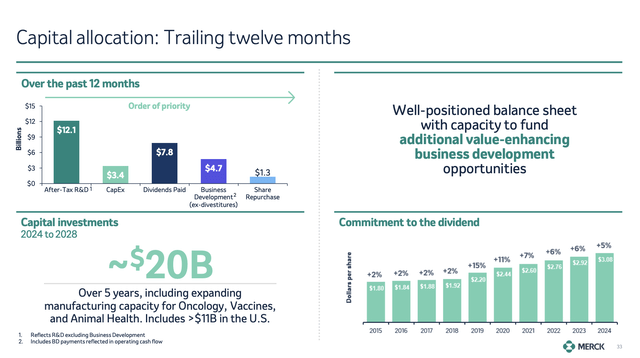

Merck has a history of consistent dividend growth and buybacks. Over the past ten years, MRK has bought back roughly 11% of its shares and hiked its dividend by 80%.

Currently yielding 3.3%, the dividend has a payout ratio around 50% and a five-year CAGR of 7.7% - all of it backed by an outstanding balance sheet. They also increased the buyback authorisation from $10 billion to $12 billion recently, which is around 5% of its market cap. However, these buybacks will be put to work rather slowly, as the main focus remains on innovation. That being said I like buybacks being increased while the share price is down, as it signals management may think the company is undervalued.

Great Valuation

To assess the risk/reward ratio, we need to look past 2025, as it is going to be an outlier year due to the Gardasil issues previously mentioned. These problems are now being priced in by the market, with MRK currently trading at $90.74 at the time of writing.

In 2027, analysts are looking for $10.90 in EPS, slightly more than 40% above its 2023 result, indicating high single-digit annual EPS growth. Applying a 16x PE Ratio (it’s 10-year average), we get a fair stock price of $174 in 2027, which is almost twice its current price. This would be an average share price increase of 24% YoY, almost certainly a significant outperformance.

With that said, MRK will almost certainly not double anytime soon, as investors will become increasingly worried about the potential Keytruda patent loss in 2028. While I expect MRK to easy survive this headwind the same way AbbVie dealt with its Humira patent loss, it could definitely keep the PE ratio under 16x over the next few years.

Conclusion

In my opinion Merck is an attractive investment opportunity at its current discounted valuation, with a forward PE of 12.7x, strong pipeline advancements, and a well-supported 3.3% dividend yield. It’s long term revenue, free cash flow and dividend growth trends have been nothing but impressive.

I think the market has overreacted to short term headwinds, and I think this is one of the best of the multiple promising healthcare stocks at current valuations. As such I think Merck is a Buy.