PayPal - Finally Waking Up?

An In-Depth Earnings Analysis

For several years, PayPal has been a source of frustration for investors. Before its latest earnings announcement, the stock had lost approximately 17.7% since the beginning of the year, a performance that displayed the pessimism surrounding its future. Yet, following the release of its third-quarter 2025 results, something shifted. There was a surge of optimism in the market, which reacted by sending the shares up by over 11% in a single session, with premarket trading showing a jump of nearly 15%.

And then just as quick as this jump happened, the stock almost immediately returned to the levels it had been at pre-earnings. This is extremely interesting to me. The earnings seemed to be unequivocally positive, so why has the share price barely moved?

This article will look into the details of the recent financial report and the new strategic direction under Alex Chriss. It will first examine the positive elements that suggest a real turnaround is underway, before assessing the persistent risks and weaknesses that could derail any recovery.

The Foundations of the Turnaround

The bull case for PayPal rests on the argument that the third-quarter 2025 report was more than a simple beat on headline figures. It was a signal of a deeper, more meaningful strategic shift. The quality of the results, the clarity of the new chief executive’s vision, and the actions taken to restore investor confidence all point towards the beginnings of a credible recovery.

More Than Just a Beat

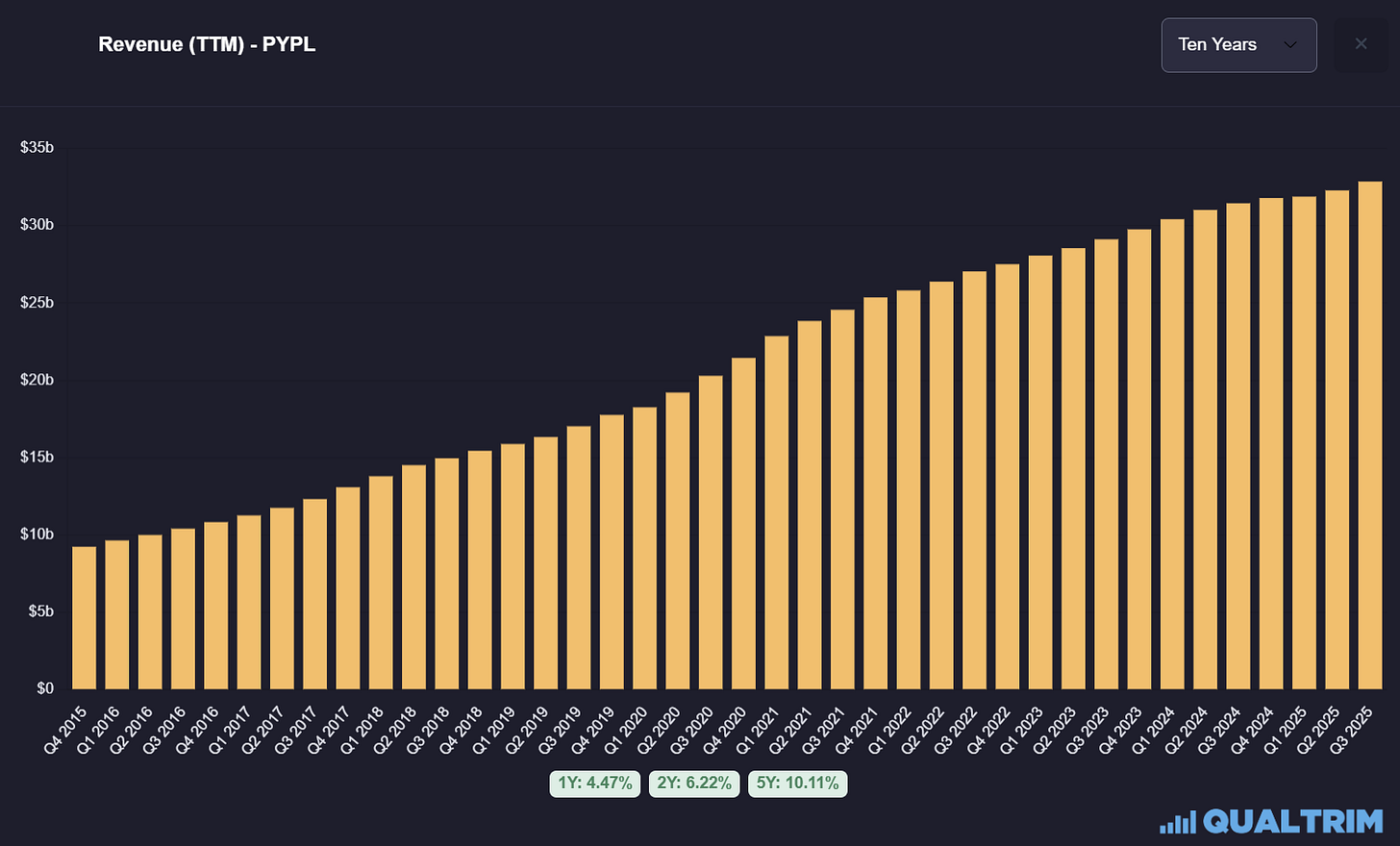

At first glance, the results for the third quarter of 2025 were strong. Very strong. The company posted net revenues of $8.42 billion, comfortably ahead of analyst estimates. This was a 7.3% increase compared to the same period last year. On the bottom line, non-GAAP EPS came in at $1.34, once again significantly outperforming the consensus estimate.

However, the real story lies beneath these headline numbers. The quality of the growth suggests a more disciplined and focused strategy is taking hold. Total Payment Volume (TPV), or the total value of transactions processed, grew a healthy 8.4% to $458.1 billion. More importantly, transaction margin dollars, a key metric of profitability, increased by 5.9% to $3.87 billion. When excluding the impact of interest earned on customer balances, this figure grew by 7.1%. This indicates that the company is successfully focusing on more profitable transactions.

A closer look at the revenue segments reinforces this point. While core transaction revenues grew by a respectable 6.4%, the more strategic Value Added Services segment expanded by an impressive 14.7%. This points to successful product diversification and an increasing ability to cross-sell services beyond basic payment processing. Furthermore, international revenue growth of 10.1% outpaced domestic growth of 5.2%, demonstrating continued strength in global markets. The shift towards higher-margin activities suggests a deliberate move towards profitability over sheer volume, a sign of a more disciplined management approach that the company has needed for a long time.

The Chriss Strategy

For the first time in years, PayPal appears to have a coherent and forward-looking plan, articulated by its new CEO, Alex Chriss. His strategy centres on positioning the company to capitalise on what he terms three “generational shifts”: the move towards digital wallets, the rise of Buy Now, Pay Later (BNPL), and the emergence of AI-powered “agentic commerce”.

The centrepiece of this new vision is the bet on AI. The company has announced strategic partnerships with OpenAI, Google, and Perplexity. This is a strategic move to establish PayPal as the default payment layer for the next generation of commerce, where AI agents make purchases on behalf of users. The partnership with OpenAI, which enables instant checkout directly within ChatGPT, is the first evidence of this strategy in action. This move cleverly leapfrogs the current competitive battlefield. For years, PayPal has been losing ground in the unbranded checkout space to rivals like Stripe and Adyen. Instead of fighting a defensive war over its legacy market, the OpenAI partnership repositions PayPal to gain a first-mover advantage in a potentially vast new market where the “website” is an AI chatbot. It shifts the investment narrative from past failures to future opportunities.

This forward-looking strategy is supported by progress in strengthening the company’s core offerings. The redesigned checkout experience is already showing conversion gains of 2% to 5% in optimised groups. Meanwhile, the existing souces engines of Venmo and BNPL continue to deliver. Venmo’s revenue growth exceeded 20% in the quarter, and BNPL volumes also grew by over 20%, demonstrating that the foundational business remains strong.

Capital Discipline and Shareholder Returns

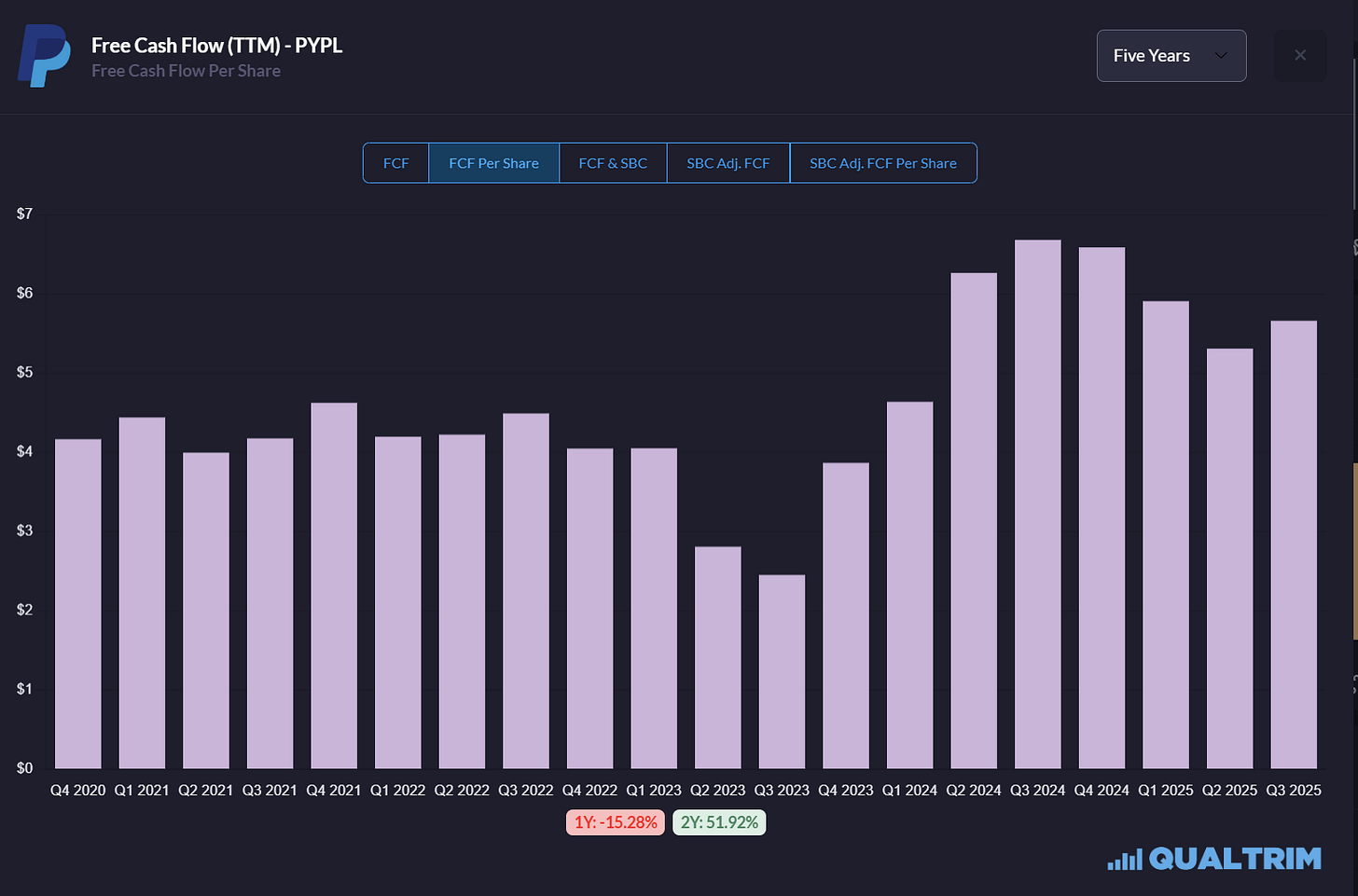

Perhaps the most powerful signals of management’s confidence came in the form of its capital allocation announcements. The company initiated its first-ever dividend and announced a substantial $6 billion share repurchase programme. For a company whose stock has performed so terribly, these actions speak volumes. They signal a belief from management that the business has stabilised, that it is generating strong and predictable FCF, and that its shares are fundamentally undervalued.

This confidence is backed by a strong financial outlook. The company expects to generate 6-7 billion dollars in FCF for the full year 2025. This provides a credible foundation for the capital return programme. Crucially, these actions are accompanied by raised full-year guidance. The company now expects non-GAAP EPS to grow by 15% to 16% for 2025, an increase from the previous forecast.

The initiation of a dividend is particularly significant. It marks an identity shift for PayPal, from a growth-at-all-costs technology company to a mature, profitable firm focused on Growth at a Reasonable Price, or GARP. For years, PayPal followed the typical tech playbook of reinvesting all cash flow to maximise growth. A dividend is a formal admission that the hyper-growth phase is over. While this may seem negative, it is a positive change in direction that attracts a new class of value-oriented and dividend-growth investors who had previously ignored the stock. It forces the market to re-evaluate PayPal based on its FCF yield and shareholder returns, not just its revenue growth multiple, providing a new valuation floor for the shares.

The Ghosts of Stagnation Past

Despite the optimism, a credible bear case remains. Significant risks and unresolved issues could easily derail the turnaround. The positive developments must be weighed against the ghosts of past stagnation, which have not yet been fully exorcised.

The Shrinking Transaction Puzzle

The most alarming metric in the third-quarter report was the decline in total payment transactions, which fell by 4.5% YoY to 6.33 billion. On a TTM basis, the number of transactions per active account dropped by 6.2%. For any payments company, a decline in transaction volume is a major red flag that cannot be ignored.

Management’s explanation is that this decline is largely intentional. It stems from a strategic de-emphasis of the very low-margin Payment Service Provider (PSP), or unbranded, business. The company argues that by focusing on higher-quality, branded transactions, it is improving overall profitability. Indeed, when the low-margin PSP transactions are excluded, payment transactions actually increased by a healthy 7%.

While shedding unprofitable volume is a sensible business decision, this metric also tells a story of lost market share. The unbranded checkout is the primary battleground where PayPal competes with formidable rivals like Adyen and Stripe. By retreating from this fight, even if it is for low-margin business, PayPal is ceding ground. This could have long-term strategic consequences, reducing the company’s overall ubiquity in the e-commerce landscape and diminishing its valuable data collection capabilities. This reveals a strategic trilemma for the company: it can prioritise high-margin branded growth, high-volume unbranded market share, or near-term profitability. It has chosen to focus on branded growth and profitability at the expense of unbranded market share, a choice that carries a decent amount of long-term risk.

The Price of Progress

Executing the new, ambitious strategy will not be cheap. Management was clear in its commentary that increased spending on product development, marketing, and customer incentives will be necessary to drive the turnaround. These investments are expected to “moderate near-term earnings growth” and create “investment-driven margin headwinds”. The first signs of this pressure may already be visible, as the company’s transaction margin shrank by 60 basis points in the quarter.

This creates a significant execution risk. The success of the turnaround is now entirely dependent on the return generated by this new wave of investment. Given PayPal’s recent history of strategic missteps and failed initiatives, investor confidence is fragile. The rollout of the redesigned checkout, for instance, is described by the company as “complex and still in progress,” highlighting the operational challenges ahead.

This situation also creates a direct contradiction that investors must confront. The market initially celebrated the raised EPS guidance of 15% to 16% growth for 2025. Yet, in the same earnings announcement, management warned that necessary investments will pressure margins and could moderate earnings growth in the future. This implies that the current guidance might have been the easy part, achieved through initial cost discipline and momentum from a few key areas. The real test will come in subsequent quarters when the full weight of the new investment cycle hits the income statement. Investors who are buying the stock today based on the current EPS trajectory may be disappointed if margins compress more than expected in 2026 and beyond.

Weighing the Risk and Reward

PayPal today is a classic turnaround play. The first signs of a recovery are visible. The third quarter was strong, driven by high-quality growth in profitable segments. The new chief executive has articulated a credible and forward-looking strategy centred on AI and agentic commerce. Furthermore, the company has demonstrated a renewed commitment to shareholder returns through the initiation of a dividend and a significant buyback programme.

However, the risks remain substantial. The decline in overall transaction volume, while partly strategic, signals a clear loss of market share in the fiercely competitive unbranded checkout space. The new strategy carries significant execution risk, and management has been transparent that the required investments will put pressure on profit margins in the near term.

Despite the recent share price increase, the stock remains far below its historical highs, suggesting that while some optimism is being priced in, the market is still a long way from being convinced of a full recovery. This valuation offers a large degree of safety if the turnaround merely stabilises the business, but it provides significant upside if the new strategy truly succeeds.

For investors with a medium to long-term time horizon and a tolerance for the inherent risks of a corporate turnaround, the current valuation offers a very attractive entry point into a story where sentiment has only just begun to shift. The ghosts of the past have not been fully banished, but for the first time in years, PayPal is facing the future with a credible plan. It is, therefore, a buy.

Really enjoyed this analysis! The AI partnerships with OpenAI and Perplexity are intresing but I'm curious if they can actually drive meaninful revenue growth. The 4.5% decline in transaction volme is concerning even if management says its intentional. Feels like PayPal is trying to pivot away from competing with Stripe instead of fighting for market share. I do like that they initiated a dividend though, shows some confidence in the business model going forward.