Pfizer became a household name during the pandemic, its Comirnaty vaccine a symbol of scientific triumph against a global crisis. Yet, despite this unprecedented visibility and the initial surge in revenues, the company's share price has conspicuously lagged in the post-pandemic era. This divergence reflects a pharmaceutical behemoth navigating a complex and challenging transition. The company grapples with the steep decline of its COVID-19 related revenues, the intricate task of integrating its largest-ever acquisition in Seagen, and the looming spectre of significant patent expirations for several key drugs. Against this backdrop, however, Pfizer points to robust growth in its core non-COVID business and tempts investors with a remarkably high dividend yield.

This confluence of factors presents a critical question for investors: Is the market unfairly punishing Pfizer for its past, pandemic-driven success and overstating future uncertainties, thereby creating a compelling deep value opportunity? Or are the substantial risks associated with patent cliffs, high debt, and recent pipeline disappointments simply too significant, marking the stock as a potential value trap? The path forward appears undeniably challenging, heavily reliant on management's execution across multiple fronts. For investors, assessing Pfizer today requires careful consideration of whether the potential rewards justify the considerable risks involved.

Financial Health

The extraordinary revenues generated by Pfizer's COVID-19 products, namely the Comirnaty vaccine (developed with BioNTech) and the Paxlovid antiviral treatment, were always destined to recede from their peak levels. As the pandemic's urgency lessened, demand naturally moderated, leading to a significant impact on Pfizer's overall top-line financial results. Full-year 2024 revenues came in at $63.6 billion, a figure reflecting this normalisation but still showing 7% year-over-year operational growth.

Crucially, however, looking beneath the headline numbers reveals a healthier underlying business. Excluding the contributions from Comirnaty and Paxlovid, Pfizer's core portfolio demonstrated impressive operational growth of 12% for the full year 2024. This resilience was evident in the fourth quarter of 2024 as well, where non-COVID operational revenue grew 11%. This growth was powered by strong performances from established products like the Vyndaqel family (Vyndaqel, Vyndamax, Vynmac) for transthyretin amyloidosis, which saw global operational growth of 60% in Q4 2024, driven by increased patient diagnosis and uptake, particularly in the US and developed international markets. Blood thinner Eliquis, shared with Bristol Myers Squibb, also contributed significantly with 13% operational growth in the quarter. Furthermore, the initial contribution from the newly acquired Seagen portfolio added $915 million in Q4 2024 revenues.

Adding another layer to the financial picture is Pfizer's recent track record on earnings. The company has consistently beaten Wall Street's earnings per share (EPS) estimates over the last four reported quarters. For the full year 2024, adjusted diluted EPS was $3.11, while Q4 2024 adjusted diluted EPS came in at $0.63, comfortably ahead of the $0.48 consensus forecast. This consistent outperformance, coupled with demonstrable progress on cost reduction initiatives, suggests management is maintaining a firm grip on operational execution during this period of significant strategic realignment. The ability to deliver on controllable factors like cost savings and operational efficiency, even amidst the headwinds of declining COVID revenues and upcoming patent challenges, provides a degree of reassurance about management's capability to navigate the transition.

Looking ahead, Pfizer has reaffirmed its financial guidance for the full year 2025. The company projects total revenues in the range of $61.0 to $64.0 billion. This guidance anticipates that revenues from COVID-19 products will remain largely stable compared to 2024 (excluding certain non-recurring Paxlovid items from 2024). Consequently, the expected operational revenue growth year-over-year is modest, forecast to be between flat and 5% compared to the 2024 baseline.

However, the guidance for adjusted diluted EPS is notably more optimistic, projected in a range of $2.80 to $3.00. This represents an expected operational growth of 10% to 18% year-over-year from the midpoint of the 2024 baseline guidance. The significant difference between the modest revenue growth forecast and the much stronger EPS growth projection underscores a critical point: near-term earnings improvement for Pfizer is heavily dependent on enhancing profit margins through rigorous cost control, rather than relying solely on sales expansion. Management has explicitly stated its goal to return to pre-pandemic operating margins in the coming years.

The primary engine for this margin improvement is Pfizer's extensive cost realignment program. The company successfully achieved its initial $4 billion net cost savings target by the end of 2024 and has increased the overall target to approximately $4.5 billion in savings by the end of 2025. An additional $1.5 billion in net cost savings is anticipated by the end of 2027 from the first phase of a separate Manufacturing Optimization Program, with initial benefits expected in late 2025. These cost-saving efforts are reflected in the 2025 guidance for adjusted Selling, Informational & Administrative (SI&A) expenses ($13.3 to $14.3 billion) and adjusted Research & Development (R&D) expenses ($10.7 to $11.7 billion).

Investors will soon get an update on progress when Pfizer reports its first-quarter 2025 results, expected before the market opens on April 29, 2025. Analyst consensus forecasts anticipate an EPS of around $0.67 for the quarter, a decline from the $0.82 reported in the same quarter last year, reflecting the ongoing impact of lower COVID-related sales.

Doubling Down on Cancer, Faltering in Fat

Facing the decline of its COVID-19 franchise and impending patent expirations, Pfizer made a decisive strategic move with the acquisition of Seagen for approximately $43 billion, completed in December 2023. This historic investment, one of the largest in Pfizer's history, firmly establishes the company as a major force in oncology. The rationale was clear: gain access to Seagen's world-leading Antibody-Drug Conjugate (ADC) technology and bolster Pfizer's cancer treatment pipeline.

The deal brought four approved cancer medicines into Pfizer's portfolio: Adcetris (brentuximab vedotin), Padcev (enfortumab vedotin), Tivdak (tisotumab vedotin), and Tukysa (tucatinib). Consequently, Pfizer's oncology portfolio now boasts over 25 approved medicines and biosimilars across more than 40 indications. Perhaps more importantly for the future, the acquisition doubled the size of Pfizer's oncology pipeline to 60 programs spanning multiple modalities including ADCs, small molecules, and immunotherapies. To maximise the impact of this acquisition, Pfizer restructured its commercial operations, creating a dedicated end-to-end Pfizer Oncology Division led by Dr. Chris Boshoff, the company's Chief Oncology Officer.

However, Pfizer's strategic repositioning suffered a significant blow recently in another high-profile therapeutic area: obesity. In April 2025, the company announced the discontinuation of its investigational oral GLP-1 receptor agonist, danuglipron (PF-06882961), which was being developed for chronic weight management. While dose-optimisation studies for a once-daily formulation had met key pharmacokinetic objectives and suggested potential for competitive efficacy and tolerability, the decision to halt development was made after a review of all clinical data, recent regulatory input, and crucially, the identification of a potential case of drug-induced liver injury in a single asymptomatic participant in one of the studies. Although Pfizer noted the overall frequency of liver enzyme elevations across the 1,400-participant safety database was in line with other approved drugs in the class, the potential liver injury signal proved decisive.

This setback is particularly damaging as it marks the second failure for Pfizer in the oral GLP-1 space. Development of a twice-daily formulation of danuglipron was halted in December 2023 due to high rates of gastrointestinal side effects, including nausea and vomiting, leading to high discontinuation rates in trials. Furthermore, this followed the termination of another oral GLP-1 candidate, lotiglipron, in June 2023, also due to liver safety concerns (elevated transaminases). These successive failures severely dent Pfizer's ambitions to challenge Eli Lilly and Novo Nordisk, whose injectable GLP-1 drugs dominate the multi-billion dollar obesity market.

The repeated pipeline setbacks in such a critical growth area inevitably raise questions. It increases the pressure substantially on the newly acquired Seagen assets and the broader oncology pipeline to deliver the growth needed to offset both the lost opportunity in obesity and the upcoming patent expirations elsewhere in the portfolio. Successful integration of Seagen and flawless execution within the new Pfizer Oncology Division are now more critical than ever.

Moreover, the pattern of discontinuing promising candidates due to safety concerns, particularly after significant investment, lends credence to some of the criticisms previously levelled by activist investors like Starboard Value, who questioned Pfizer's R&D productivity and the value derived from its M&A activities. This track record may suggest challenges in internal drug development capabilities in certain highly competitive fields and could potentially push Pfizer towards seeking external solutions through further acquisitions or partnerships, as some analysts speculate.

Despite the obesity disappointment, Pfizer maintains a broad pipeline across other key therapeutic areas. In Vaccines, the company recently saw an expanded recommendation for its RSV vaccine Abrysvo to include adults aged 50-59 at increased risk. Internal Medicine remains a focus, targeting cardiovascular and metabolic diseases. The Inflammation & Immunology division continues its work , and the pipeline includes late-stage gene therapy candidates for Hemophilia A and B (giroctocogene fitelparvovec and fidanacogene elaparvovec respectively), both holding Breakthrough Therapy designations in the US.

Dirt Cheap Stock, Dangerously High Dividend?

One of the most striking aspects of Pfizer's current investment profile is its valuation. Compared to pharmaceutical peers, particularly those enjoying success in high-growth areas like obesity, Pfizer appears remarkably inexpensive. Its trailing twelve-month (TTM) Price/Earnings (P/E) ratio sits around 18, but its forward P/E ratio, based on analyst expectations for future earnings, is significantly lower at approximately 8.6. Other metrics reinforce this picture: the Price/Sales (P/S) ratio is around 2, and the Price/Book (P/B) ratio is roughly 1.5.

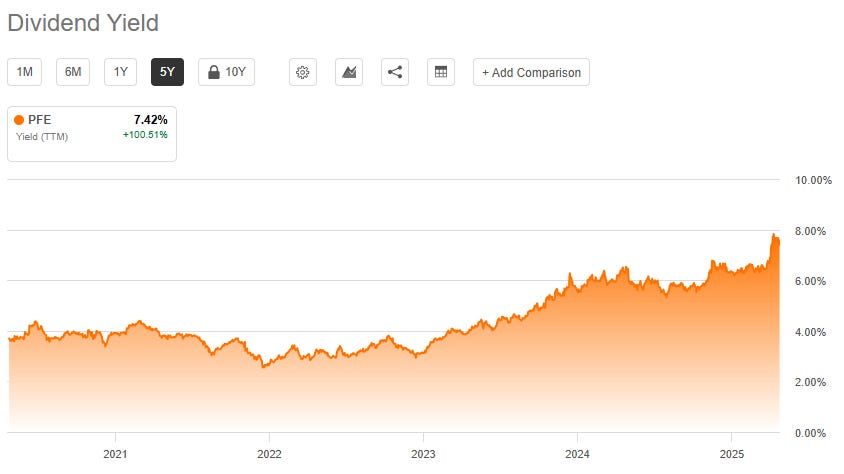

Complementing the low valuation is an exceptionally high dividend yield, currently standing above 7%. Pfizer boasts a long and consistent history of returning cash to shareholders, having paid a dividend for 345 consecutive quarters and increased its dividend for 16 consecutive years. Most recently, the board approved an increase in the quarterly dividend to $0.43 per share for the first quarter of 2025.

However, the sustainability of this generous dividend is a major point of debate. The TTM dividend payout ratio currently exceeds 100% of earnings, recorded at 118-122% in recent analyses. A payout ratio this high is fundamentally unsustainable in the long run unless earnings significantly improve or the company funds the dividend through other means, such as asset sales or borrowing – the latter being problematic given Pfizer's already substantial debt load.

This situation frames the central dilemma for potential investors. The combination of rock-bottom valuation multiples and a sky-high dividend yield presents classic signs of a value stock. Yet, the significant risks – looming patent cliffs, high debt, the elevated payout ratio, and recent pipeline stumbles – are undeniable. These factors could prevent the stock from re-rating higher, potentially trapping investors who bought based on the apparent cheapness. The low price reflects genuine concerns, and the investment decision hinges on whether the potential rewards from a successful turnaround outweigh these substantial threats.

In this context, the recent decision to increase the dividend again, despite the financial pressures, can be viewed in two ways. Management likely intends it as a signal of confidence in future earnings power and cash flow generation, reaffirming their commitment to shareholder returns. However, maintaining and growing the dividend at this level consumes significant cash flow that could otherwise be directed towards debt reduction – a stated priority for 2025 – or preserving flexibility for future M&A, which might become necessary given pipeline gaps. With share repurchases already paused to conserve capital, the dividend policy represents a delicate balancing act between projecting confidence and managing financial constraints.

Patents and Payables

While Pfizer works to reshape its future through acquisitions and pipeline development, significant challenges loom, most notably a formidable patent cliff. Several of the company's largest revenue-generating drugs are scheduled to lose market exclusivity in the coming years, exposing them to competition from cheaper generic or biosimilar versions. Key products facing this threat include the blood thinner Eliquis (apixaban), co-marketed with BMS, whose key patents expire between 2027 and 2029. The breast cancer drug Ibrance (palbociclib) recently received a patent term extension in the US, but only until March 2027.

Other major drugs nearing the end of their protected market life include the transthyretin amyloidosis treatment Vyndaqel/Vyndamax (tafamidis), whose basic US patent expired at the end of 2024, although Pfizer hopes pending patent term extensions could push exclusivity out to 2028. The JAK inhibitor Xeljanz (tofacitinib) also faces generic pressure , as does the prostate cancer drug Xtandi (enzalutamide), shared with Astellas, which loses US patent protection in 2027.

The potential financial impact of these losses of exclusivity (LOEs) is substantial. Analysts project significant revenue erosion for these blockbusters once competition arrives. SVB Leerink, for instance, estimated potential revenue losses by 2030 of $6.1 billion for Eliquis and $4.8 billion for Ibrance compared to their anticipated 2025 revenues. The same analysis projected losses of $2.7 billion for Vyndaqel/Vyndamax and $1.8 billion for Xeljanz over the same period. Another source broadly estimated that Pfizer could face up to $18 billion in revenue loss due to patent expirations between 2025 and 2030. Historically, the entry of generic or biosimilar competition leads to rapid and substantial decreases in revenue for the original product.

This impending revenue gap underscores the critical urgency for Pfizer's pipeline, particularly the newly bolstered oncology portfolio resulting from the Seagen acquisition, to deliver new commercially successful products. The company is effectively in a race against time to launch new blockbusters and ramp up their sales before the full impact of the patent cliff materialises post-2025/2027. The successful integration of Seagen and the execution of late-stage oncology trials over the next two to three years are therefore paramount to navigating this transition successfully.

Compounding the challenge is Pfizer's significant debt burden. Following major acquisitions, most notably the $43 billion Seagen deal, the company carries substantial debt on its balance sheet. Net debt was reported at approximately $58 billion, with a debt-to-equity ratio around 0.73. While a company of Pfizer's scale can manage significant debt, the current level, combined with rising interest rate possibilities, necessitates caution. Management has clearly identified de-leveraging the balance sheet as a priority, aiming to achieve sufficient progress by the end of 2025 to regain flexibility in capital allocation.

This combination of high debt, the commitment to funding a large dividend payout (currently exceeding earnings), and the ongoing need for substantial R&D investment (guided at $10.7-$11.7 billion for 2025) significantly restricts Pfizer's financial manoeuvrability. It limits the capacity for further large-scale M&A, even if pipeline gaps suggest a need, and explains the current suspension of the share repurchase program. Pfizer faces competing demands for its capital, which will likely remain constrained until the balance sheet improves.

Finally, external factors add further pressure. The Inflation Reduction Act (IRA) in the US is expected to create a net unfavourable revenue impact of approximately $1 billion in 2025 due to changes in Medicare Part D drug pricing mechanisms. While Pfizer has also faced scrutiny from activist investors like Starboard Value regarding its spending and strategic direction in the recent past, though Starboard did not proceed with a board nomination for the 2025 meeting.

Weighing the Scales – A Bet on Execution?

Evaluating Pfizer today involves balancing significant potential against substantial risks. The bull case rests on the demonstrated strength of the core non-COVID business, which continues to grow operationally at a healthy double-digit rate. The transformative Seagen acquisition has created a powerhouse in oncology with leading ADC technology and a vastly expanded pipeline, offering a clear pathway to future growth. Management has also proven its ability to execute on cost control, delivering ahead of schedule on ambitious savings targets and consistently beating earnings expectations. Combined with a valuation that appears deeply discounted relative to peers and a very high dividend yield, the potential for upside is evident.

However, the bear case is equally compelling. The company faces one of the industry's most significant patent cliffs over the next five years, threatening billions in revenue from established blockbusters. This revenue gap needs to be filled while the company simultaneously manages a heavy debt load resulting from its acquisition strategy. The sustainability of the high dividend payout is questionable given current earnings levels, creating uncertainty for income investors. Furthermore, recent high-profile pipeline failures, particularly the discontinuation of two oral obesity candidates due to safety concerns, raise legitimate questions about R&D execution and increase the pressure on the oncology pipeline to perform flawlessly. Adding to these internal challenges are external pressures like the financial impact of the IRA.

Ultimately, Pfizer appears cheap for understandable reasons. The investment proposition hinges almost entirely on management's ability to navigate this complex transition successfully. This requires near-perfect execution on multiple fronts: seamlessly integrating Seagen and realising its synergistic potential, delivering timely and impactful results from the oncology pipeline, managing the financial fallout from the patent cliff, maintaining rigorous cost discipline to support margins, and steadily deleveraging the balance sheet.

For investors possessing a high tolerance for risk and a strong conviction in management's ability to steer the ship through these turbulent waters, Pfizer might offer considerable long-term value from its current depressed levels. However, the path is undeniably fraught with peril. The tempting dividend yield, while attractive on the surface, carries significant sustainability questions and should not be the sole basis for an investment decision given the high payout ratio and competing demands for capital. Pfizer currently looks less like a straightforward value opportunity and more like a calculated gamble on sustained, high-quality execution against considerable headwinds.

Thank you for reading! Let me know if you agree with what I have written. Have a great day!