Salesforce - The Empire Strikes Back

An In-Depth Analysis

The Death of Software

For the better part of two decades, the SaaS model was the undisputed king of the investment world. It offered financial perfection - predictability, high switching costs, and beautiful recurring revenue. Salesforce, the company that practically invented the model, was the perfect example. Marc Benioff did not just build a company; he built a religion around the subscription economy, turning the Customer Relationship Management (CRM) database from a digital rolodex into the central nervous system of the modern enterprise.

Yet today, the narrative has shifted violently. The prevailing wisdom is that SaaS is dead - or at the very least, terminally ill. The diagnosis is AI deflation. The logic is that if artificial intelligence can write code, handle customer service, and automate sales outreach, the need for human seats - the unit of economic value for Salesforce - will collapse. If the software sells licenses based on the number of humans using it, and AI reduces the need for humans, does the software not cannibalise its own revenue base?

This narrative has compressed the valuation of Salesforce to levels that would have seemed absurd just three years ago. The stock, despite a recent rally following its Q3 earnings, trades at multiples that suggest it is a utility company, not a technology compounder. The market is pricing in a future where Benioff’s empire slowly bleeds out, replaced by AI-native startups or simply rendered obsolete by the efficiency of the AI it tries to sell.

Our job as investors is to distinguish between narratives and numbers. Having spent the last week looking at the company’s fiscal 2026 performance, its recent strategic acquisitions - most notably the controversial purchase of Informatica - and the mechanics of its new Agentforce platform, a different picture emerges. I think that reports of the death of Salesforce have been greatly exaggerated. What we are witnessing is not a decline, but a massive, ultimately lucrative pivot from a system of record to a system of action. Salesforce is not being eaten by AI, it is becoming the company through which enterprises will use it.

Q3 2025

The scepticism surrounding Salesforce leading up to the Q3 earnings report released on December 3, 2025, was palpable. Investors feared that the law of large numbers, combined with AI disruption, would finally slow the company down. The results, however, provided a rebuttal to the bear case, demonstrating how a mature company can successfully navigate a technological platform shift.

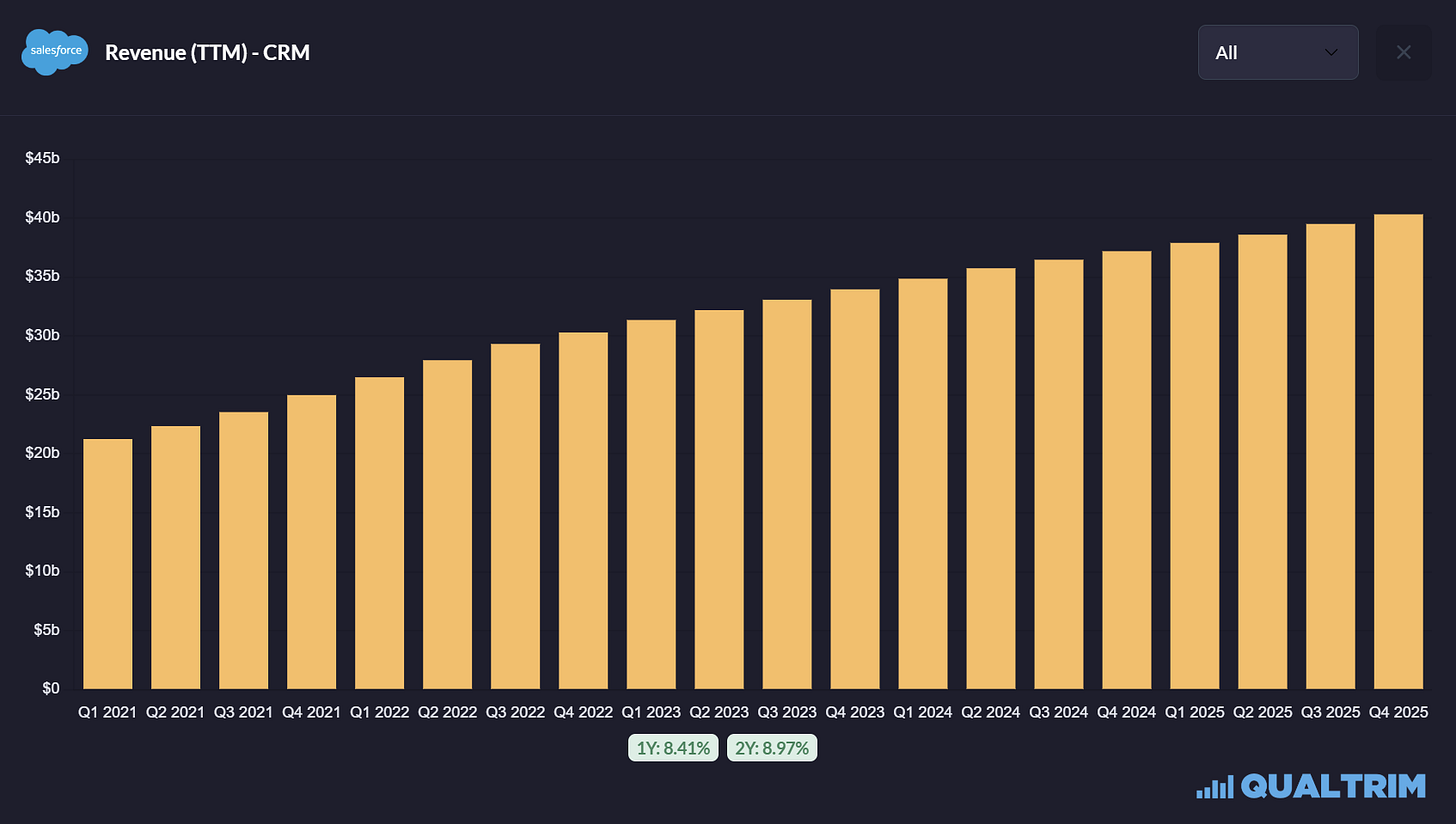

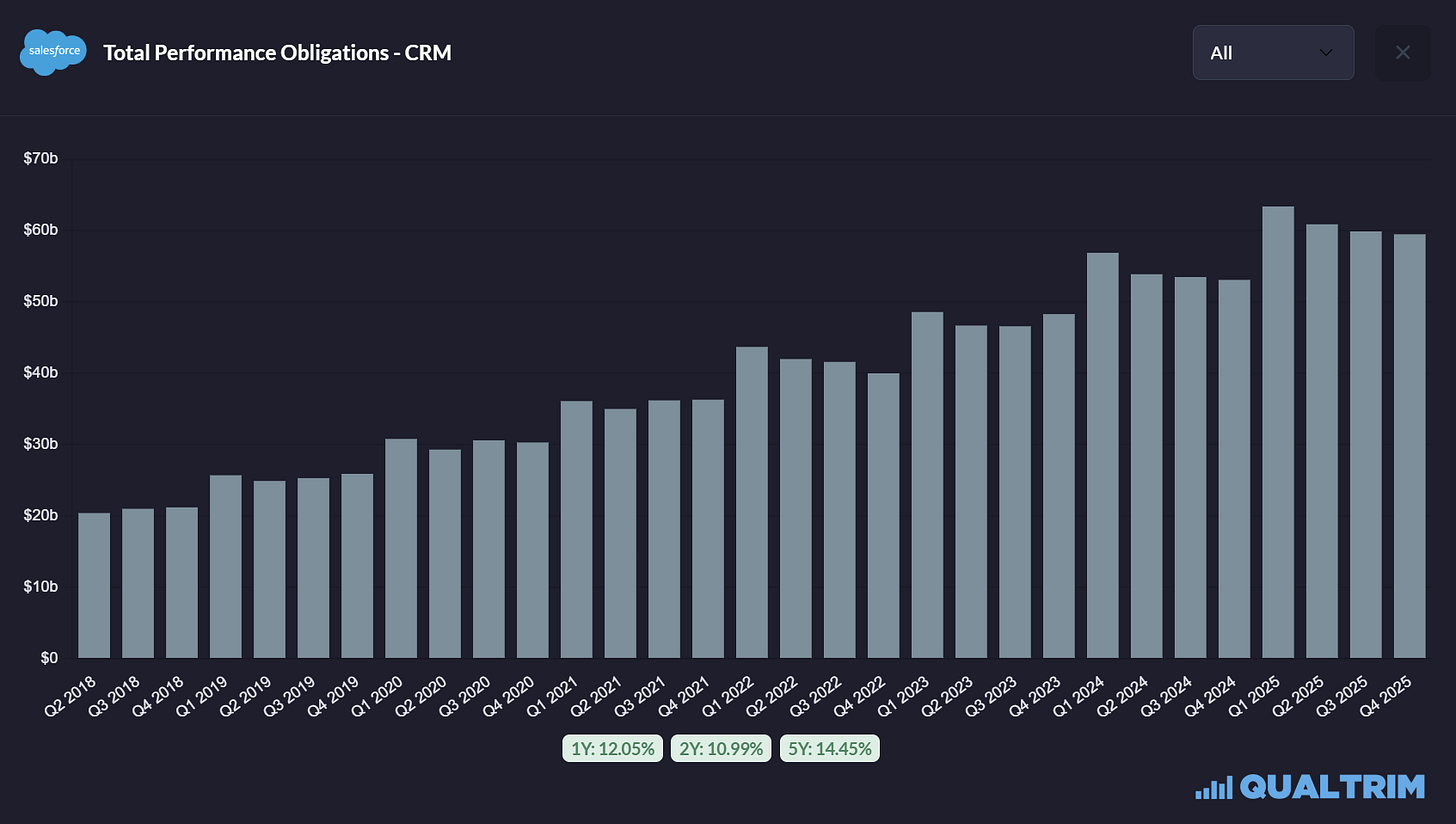

Salesforce delivered revenue of $10.3 billion for the quarter, a 9% YoY increase. In constant currency terms, growth stood at 8%, a figure that, while not the hyper-growth of the 2010s, demonstrates resilience for a company of this scale operating in a jittery macro environment. More importantly, the remaining performance obligation - the total value of future contracts - grew 12% to nearly $60 billion. This is the backlog that ensures the company’s durability; it is guaranteed future cash flows that few companies on earth can match.

But the headline revenue number conceals the true story, which lies in the profitability. For years, critics argued that Salesforce was a company run for revenue growth at the expense of shareholders, treating stock-based compensation like confetti and ignoring the bottom line. That era is over. The company reported a non-GAAP operating margin of 35.5%, an expansion of 2.4% YoY.

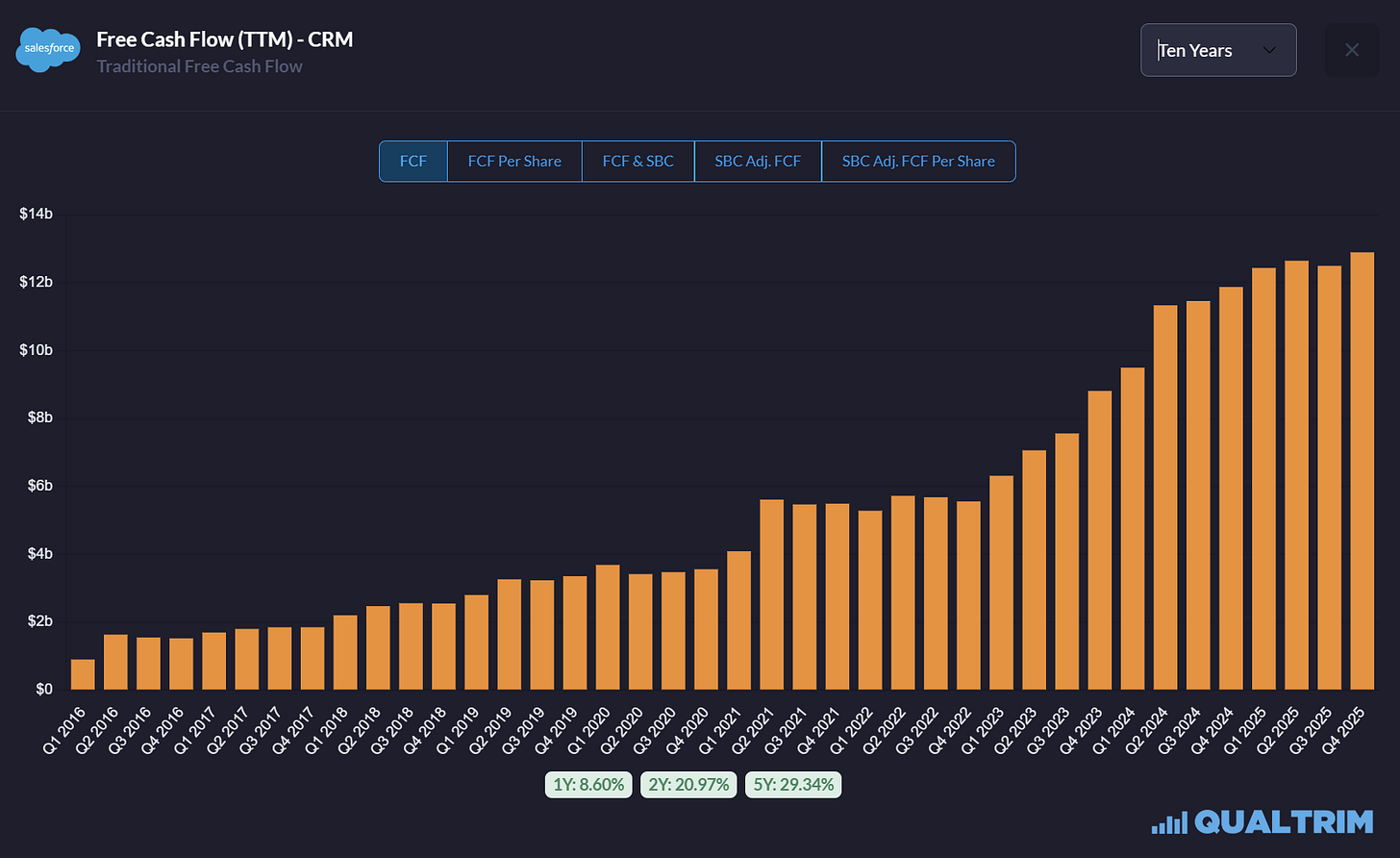

The cash generation was equally formidable. Operating cash flow rose 17% to $2.3 billion, and FCF - the best metric to measure intrinsic value - jumped 22% to $2.2 billion. When a company can grow its FCF at double the rate of its revenue, it indicates immense operating leverage. This is a clear sign of a high-quality compounder entering its maturity phase.

The disconnect between the market’s perception and the company’s reality is best illustrated by the earnings call itself. While analysts pressed for details on seat compression, management pointed to a different metric, tokens. The Agentforce platform processed over 3.2 trillion tokens in the quarter.

This is a company that has successfully transitioned from growth at all costs to profitable growth. The 2.4% expansion in margins is particularly noteworthy given the heavy investment in AI infrastructure. It suggests that Salesforce is finding efficiencies in its own operations - perhaps by using its own Agentforce tools - to fund its future without diluting shareholders.

Agentforce

The most important piece of the bull thesis - and the primary argument against the seat compression fear - is Agentforce. To understand why this matters, one must understand the shift in the business model. The traditional SaaS model monetises humans. You hire a salesperson, you buy a Salesforce license. If AI makes that salesperson five times more productive, you might hire fewer salespeople.

Agentforce flips this dynamic. It allows customers to deploy autonomous AI agents that perform tasks - resolving customer service tickets, qualifying leads, or managing marketing campaigns - without human intervention. Salesforce monetises this not just through seats, but through consumption. It is a bet that as the cost of intelligence drops, the demand for it will rise elastically. This is Jevons Paradox in action, as the efficiency of a resource increases, consumption of that resource increases rather than decreases.

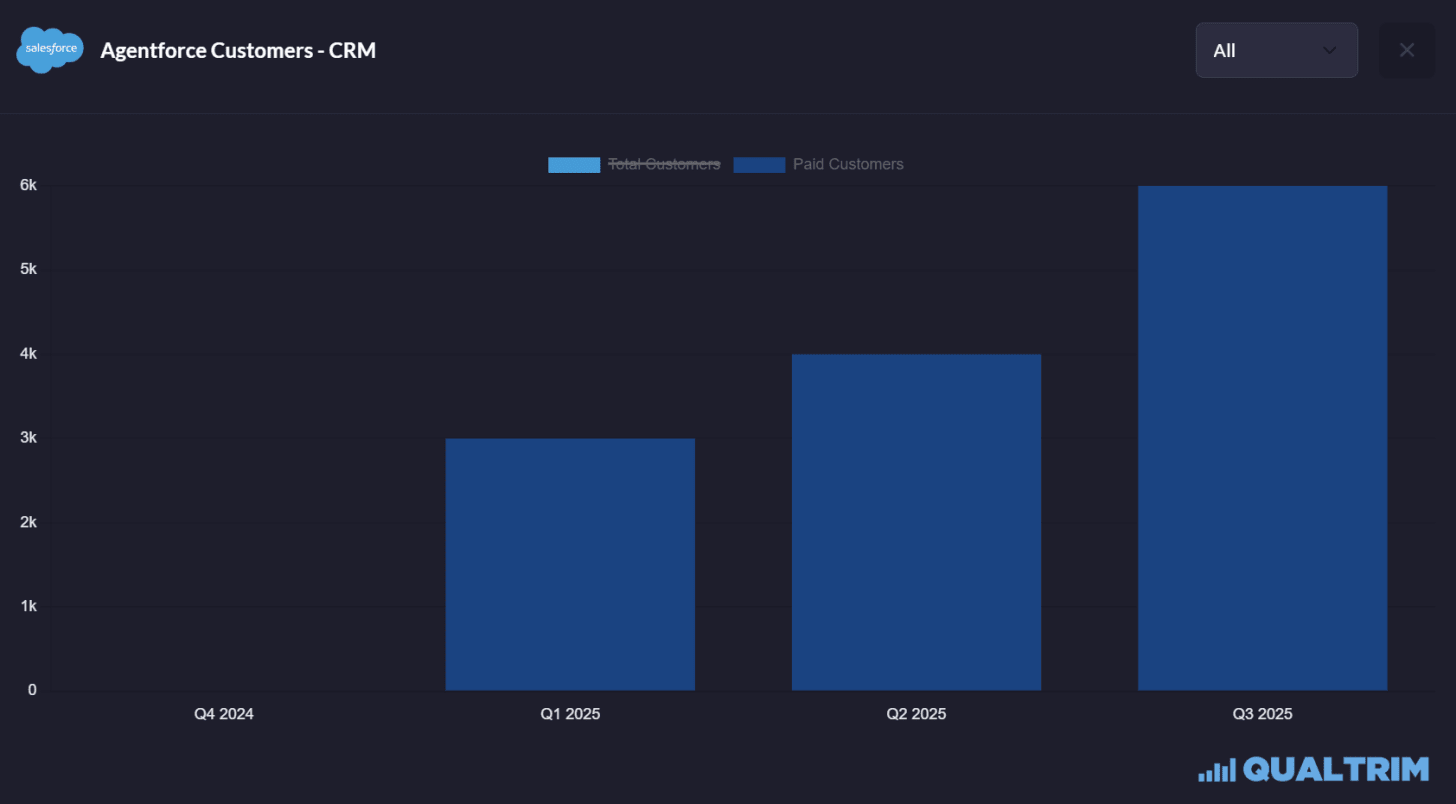

The adoption numbers released recently are explosive. Marc Benioff, never one for understatement, called Q3 the ‘quarter of Agentforce,’ but the data actually supports this. Annual Recurring Revenue, or ARR, for Agentforce and Data 360 (the rebranded Data Cloud) reached nearly $1.4 billion, an insane 114% increase YoY. Agentforce alone surpassed $500 million in ARR, growing 330% YoY.

Consider the size of that figure. A $500 million product business was created essentially from scratch in under 18 months. There are Silicon Valley unicorns that have not reached that revenue scale after a decade of operation. Salesforce has achieved this by leveraging its massive installed base. The company closed over 18,500 Agentforce deals since launch, with 9,500 of those being paid deals, a 50% increase from the previous quarter.

This rapid adoption suggests that enterprises are not looking to build their own AI solutions using raw LLMs from OpenAI or Anthropic. They want the AI to live where the work happens. If a customer service agent lives in Service Cloud, the AI agent should live there too. The friction of exporting data to a separate AI layer is too high, and the security risks too great. Salesforce has successfully positioned Agentforce as the easy solution for enterprises to leverage AI.

The metric that best illustrates the stickiness of this new model is the consumption volume. Agentforce processed over 3.2 trillion tokens in the quarter. Every token processed represents a business workflow executed, a query answered, or a decision made. It transforms Salesforce from a passive database into an active participant in the daily operations of its customers.

However, the ‘Death Valley’ risk remains. There is a theoretical period where seat revenue declines faster than consumption revenue ramps up. This is the transition risk that terrified investors earlier in the year. Yet, the Q3 data suggests Salesforce is bridging this gap. The 10% growth in subscription and support revenue implies that the core business is not collapsing, while the triple-digit growth in the new business suggests the bridge is being built faster than expected.

The Data Moat and Informatica

If there is a legitimate criticism of Salesforce’s strategy, it has historically been the fragmentation of its data. Through years of aggressive acquisitions - Tableau, MuleSoft, Slack - the company created a sprawling empire where data often sat in silos. To deploy effective AI, however, data must be unified. An AI agent cannot answer a customer’s question if the order history is in Commerce Cloud, the ticket history is in Service Cloud, and the customer interaction logs are in Slack, and none of them speak to each other.

This explains the strategic rationale behind the acquisition of Informatica, which was completed on November 18, 2025. The price tag of ~$8 billion raised eyebrows, particularly among those who felt Salesforce should be returning that capital to shareholders rather than embarking on another M&A adventure. After the failed talks in 2024, the completion of this deal in late 2025 signals a decisive move by Benioff to plug the biggest hole in the Agentforce thesis.

Viewing this acquisition through the lens of the ‘metadata moat’ reveals its necessity. Informatica is a leader in enterprise data management, specifically in Extract, Transform, and Load, as well as Master Data Management. It acts as the plumbing that connects disparate data sources across an enterprise, ensuring that data is clean, governed, and contextualised.

By absorbing Informatica, Salesforce is effectively attempting to corner the market on context. As Benioff stated, ‘without clean, connected, trusted data there is no intelligence – only hallucination’. Informatica allows Salesforce to ingest and understand data not just from within its own clouds, but from legacy on-premise systems, third-party lakes like Snowflake, and other ERP systems.

This creates a unified layer. When an Agentforce agent tries to resolve a case, it can now pull context from the entirety of the enterprise’s memory, not just the slice that sits in Salesforce. This acquisition is defensive as much as it is offensive. It prevents the commoditisation of the application layer by ensuring that the data layer - the gravity that holds the customer - remains firmly under Salesforce’s control. It validates the thesis that in the AI era, the model is a commodity, but the data is the real moat.

Critics argue that Salesforce paid a premium for a legacy technology. They point out that Informatica has struggled for growth in the past and that the integration challenges will be immense. Salesforce has a mixed track record with integration. While MuleSoft was a technical success, the integration of Slack has been rockier. However, the integration allows Salesforce to cross-sell Informatica’s capabilities to its massive customer base, potentially accelerating that growth. More importantly, it patches the reality of enterprise data, which is the primary bottleneck for AI adoption.

The deal also carries a neutrality risk. Informatica marketed itself as the ‘Switzerland of data,’ compatible with all clouds. Under Salesforce, will it remain neutral, or will it become a walled garden tool? Benioff’s history suggests a walled garden approach, which could alienate customers using competitive clouds. Yet, the necessity of the metadata moat we discussed likely outweighs these concerns.

The War for Workflows

No analysis of Salesforce is complete without addressing the elephant in the room, ServiceNow. Under the leadership of Bill McDermott, ServiceNow has been encroaching on Salesforce’s territory, moving from the IT back office into the front office of customer service and employee experience.

The distinction between the two has historically been clear: Salesforce owns the customer (CRM), and ServiceNow owns the employee/IT workflow. However, in the age of the Agentic Enterprise, these lines are blurring. Both companies are racing to become the control plane for the enterprise, the single pane of glass through which all work is orchestrated.

ServiceNow’s Now Assist is a formidable competitor to Agentforce. It is particularly strong in internal workflows - IT service management, HR onboarding, and procurement. Salesforce, conversely, dominates the external workflows - sales, marketing, and commerce. The battleground is the Service layer. Both companies want to be the engine that powers customer support.

Salesforce’s advantage lies in its data gravity. For customer-facing tasks, the data lives in the CRM. It is far easier to build an agent on top of the data where it resides than to pipe that data into a separate workflow engine. The Q3 numbers suggest that Salesforce is successfully defending this turf. The 70% QoQ increase in Agentforce accounts in production indicates that customers are choosing the integrated path.

However, investors must watch this rivalry closely. ServiceNow is a high-quality operator with a relentless sales culture. If Salesforce fumbles the integration of Informatica or if Agentforce fails to deliver real ROI, ServiceNow stands ready to capture the disillusionment. Furthermore, Microsoft’s Copilot looms over everything. While Microsoft lacks the structured transactional data of Salesforce, it owns the unstructured data (email, documents) and the interface (Office). The war for AI Agent services will be one of the defining software battles of the late 2020s.

Balance Sheet and Capital Allocation

While the new strategic direction has grabbed the headlines, the financial architecture of Salesforce remains the foundation of the investment case. The company has evolved into a capital allocation machine that rivals the best in the industry.

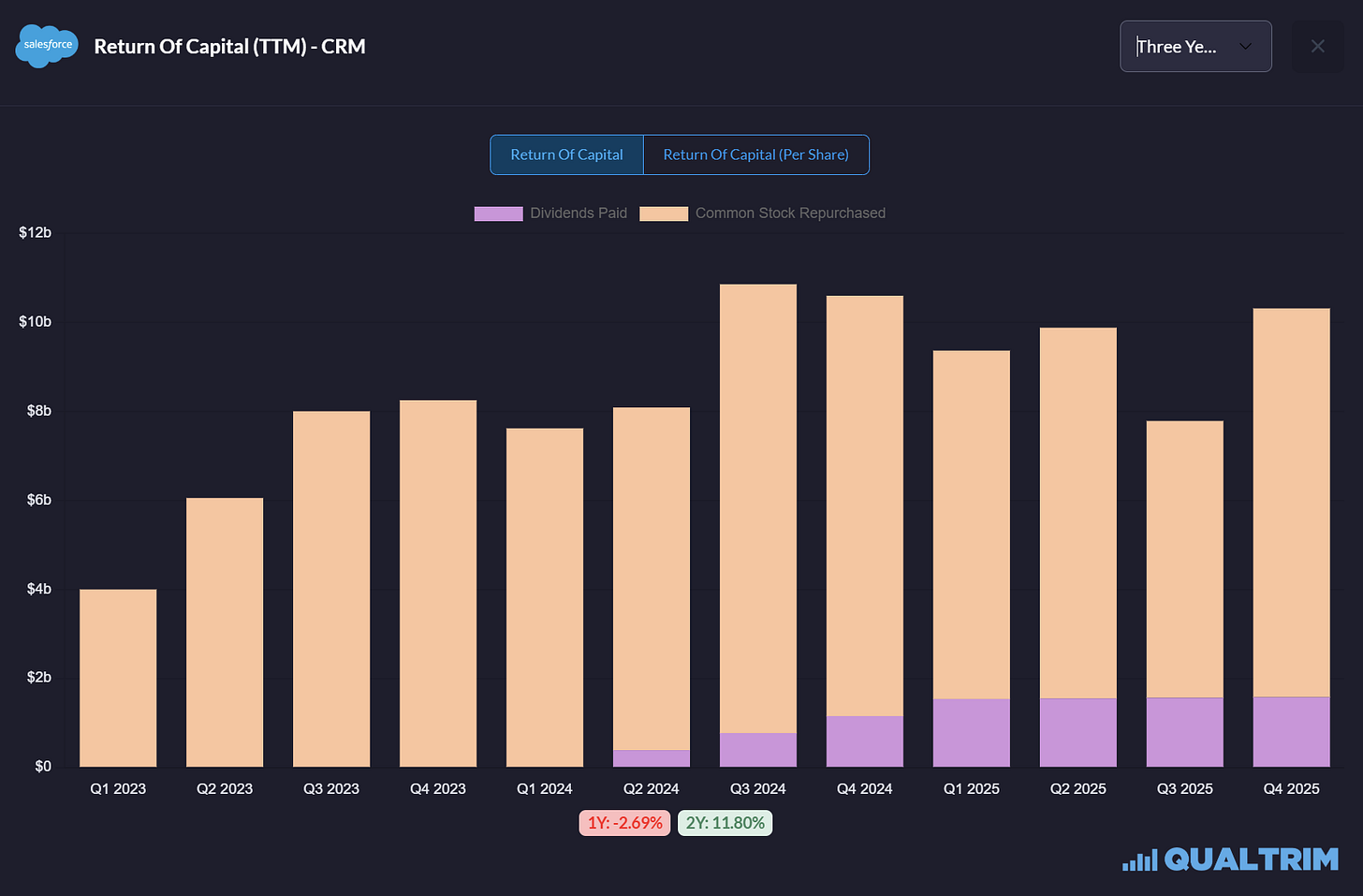

In Q3 alone, Salesforce returned $4.2 billion to shareholders. This included $3.8 billion in share repurchases and $395 million in dividends. The introduction of the dividend earlier in the year was a real turning point for me. It signals to the market that Salesforce views itself as a mature, cash-generating compounding machine, moving away from the growth at all costs mentality of its youth.

The balance sheet is pristine, and the company’s ability to generate cash is resilient to economic cycles. Even as revenue growth has slowed to the high single digits, the discipline on margins ensures that EPS continues to compound at a faster rate. The guidance for fiscal 2026 non-GAAP EPS was raised to a range of $11.75 to $11.77. This implies a forward P/E of ~22x at current prices - a level that is eminently reasonable for a business with this quality of earnings and competitive positioning.

Valuation

We now turn to the most critical question for the investor: Is the stock cheap?

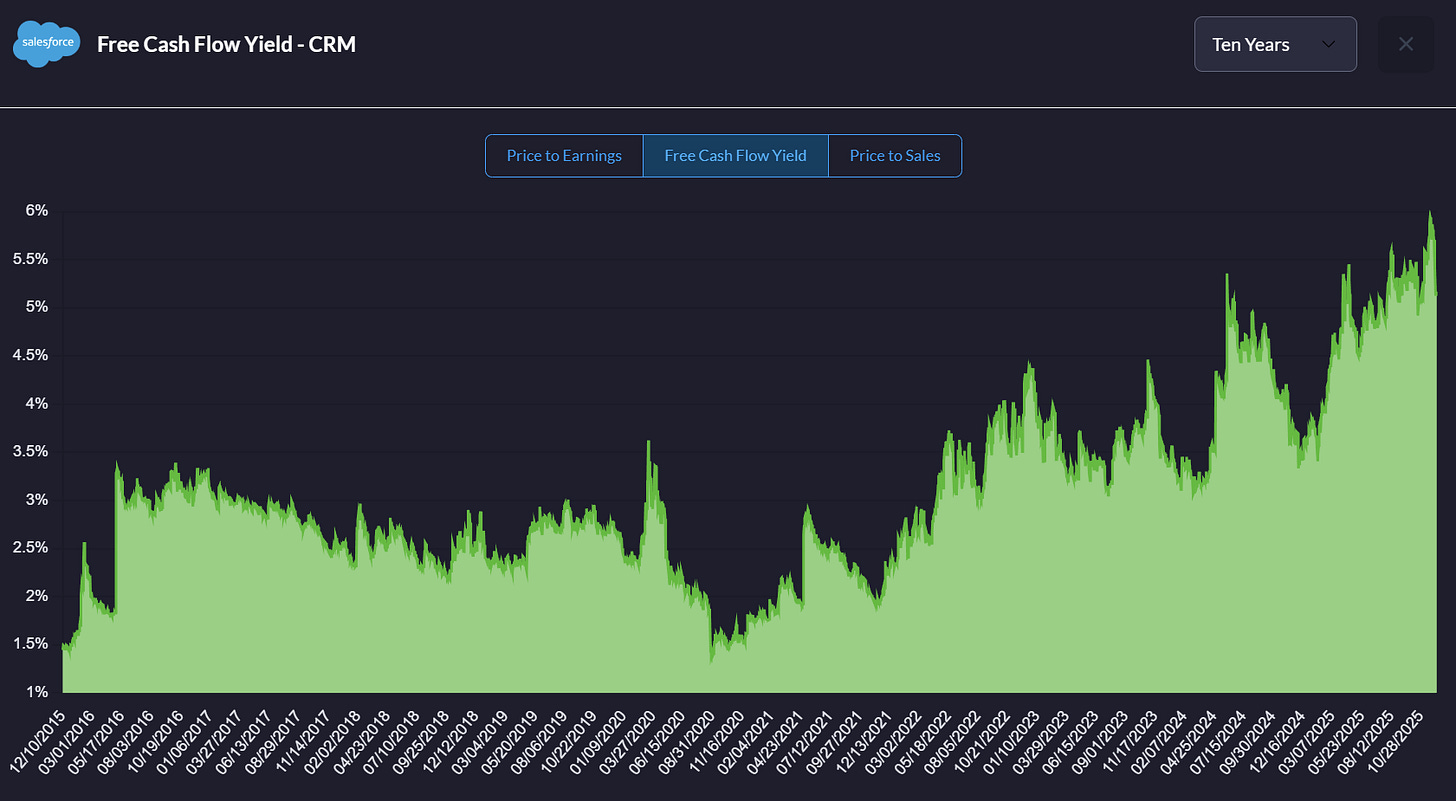

As of December, 2025, Salesforce has a market cap of ~$250 billion. The stock trades around $260. The TTM FCF is roughly $12-13 billion, implying a P/FCF ratio of roughly 19x to 20x.

To put this in perspective, for much of the last decade, Salesforce traded at P/FCF multiples in excess of 40x, often reaching 60x or higher during periods of peak optimism. The current valuation reflects a market that has priced in a permanent slowdown of growth. It assumes that the single-digit revenue growth is the new normal and that the AI threat is existential.

This is where the opportunity lies. If one believes, as the evidence suggests, that Agentforce will drive a re-acceleration of revenue - or at the very least, a durability of retention - then paying 20x free cash flow for this asset is extremely cheap. We are buying a stream of high-quality, recurring, inflation-protected cash flow for the coming decade.

Comparison with peers highlights this discrepancy. Palantir, the market’s current AI darling, trades at multiples that require a telescope to see. ServiceNow typically trades at a significant premium to Salesforce. Even mature tech giants like Microsoft often have higher multiples despite their immense scale. Salesforce is currently priced like a legacy hardware vendor rather than the premier software platform of the global economy.

Furthermore, the share repurchase program provides a floor to the valuation. With $4.2 billion returned in a single quarter, management is aggressively taking advantage of the depressed share price. They are telling the market ‘If you won’t value our cash flows correctly, we will buy them ourselves.’

Risks & The Bear Case

The primary risk to Salesforce is execution. The company is attempting a massive technological platform shift whilst simultaneously integrating a large, complex acquisition. The history of software M&A is littered with failures. If the Informatica integration becomes a distraction, or if the large platform becomes too complex for customers to implement, the momentum could stall.

There is also the cultural risk. Salesforce has laid off thousands of employees in recent years to drive efficiency. While necessary for margins, this impacts morale. The departure of key leaders and the reliance on Benioff’s singular vision certainly creates a key person dynamic, although perhaps not as bad as say the Mark Leonard situation at Constellation Software. Benioff is synonymous with the brand. His pivots are the company’s pivots. If he were to step down or lose focus, the strategic drift could be severe.

Finally, the macro risk remains. If the global economy enters a recession, IT budgets will be slashed. While Salesforce is mission-critical, shelfware - licenses bought but not used - will be purged. The consumption model of Agentforce creates some variability. In a downturn, consumption might drop faster than seat subscriptions. However, the counter-argument is that in a downturn, companies will turn to AI agents to replace more expensive human labor, potentially making Agentforce counter-cyclical.

Conclusion

The market is currently suffering from a failure of imagination regarding Salesforce. It sees a company bound by the constraints of human seats in an era of digital labour. It sees a legacy database in an era of fluid intelligence.

What the market misses is the adaptability of the company. Salesforce has successfully navigated every major platform shift in the last 25 years. From on-premise to cloud, from desktop to mobile, from classic social to enterprise social. The shift to Agentic AI is the next evolution.

The Q3 FY2026 results are not just a beat and raise; they are a proof of concept. The explosive growth of Agentforce proves that the installed base is hungry for Salesforce’s version of AI. The margins prove that the company can generate elite profitability while investing in this transition. The acquisition of Informatica, though expensive, secures the necessary infrastructure to win the long game.

We are currently presented with a rare opportunity to buy into Salesforce - a dominant, monopolistic franchise - at a valuation that assumes it is much lower quality than it actually is. The 20x free cash flow multiple is a safety margin that buffers against execution slips.

Investors who wait for the ‘all clear’ signal - for revenue growth to return to 20% or for the AI narrative to be fully de-risked - will likely have to pay double the current price. The time to buy a compounder is when the cloud of uncertainty temporarily obscures the quality of the business.

Thank you for reading, Subscribe if you enjoyed, Leave a comment, and have a great day!

Brilliant breakdown of the Agentforce pivot. The Jevons Paradox framing is spot on, cheaper intellgence doesnt mean less revenue it means way more consumption. I'd add that the Informatica premium looks steep now but if it truely solves the data unification bottleneck it could unlock more Agentforce adoption then anyone expects.

Very well written, CRM is certainly a great stock to have.