In the ever-churning sea of the public markets, a new vessel occasionally appears that demands attention. Smith Douglas Homes Corp. (NYSE: SDHC), which cast off onto the New York Stock Exchange in January 2024, is one such company. For investors scanning the horizon for opportunities in the American housing market, SDHC presented a compelling story from the outset. Here was a homebuilder of considerable scale, already ranking as the 36th largest in the United States by closings in 2023 and climbing to 32nd just a year later, offering fresh access to a disciplined growth story.

At first glance, the company’s strategy appears to be a masterclass in positioning. It operates exclusively in the sun-drenched, high-growth markets of the Southeastern and Southern United States, with a presence in Alabama, Georgia, North Carolina, South Carolina, Tennessee, and Texas. This is precisely where demographic and employment trends have been most favourable, with cities like Raleigh, Charlotte, and Nashville acting as magnets for population growth. To be the right builder in the right place is a powerful starting point for any investment thesis.

Yet, it is the architecture of the business model itself that truly polishes the initial bull case. Smith Douglas is not attempting to be all things to all people. It has a laser focus on two of the most resilient and demographically significant segments of the housing market: entry-level buyers and empty-nesters. This is not a builder chasing the fickle luxury market, but one providing what it terms "affordable luxury" to the core of housing demand. With an average sales price hovering around $335,000, strategically positioned below the Federal Housing Administration (FHA) loan limits, the company’s value proposition is clear and potent.

This proposition is made possible by a triad of operational principles. First and foremost is a "land-light" strategy, a disciplined approach that eschews the immense capital outlay and cyclical risk of owning vast tracts of undeveloped land. Instead, the company primarily purchases finished lots through option contracts from a network of third-party developers. At the close of 2024, a remarkable 96% of its unstarted lots were controlled through such options, a testament to its capital efficiency. This approach not only conserves cash but also allows for greater flexibility in a shifting market.

Second is a deep-seated culture of operational efficiency, honed over decades by its leadership. The management team, led by founder Thomas Bradbury and CEO Greg Bennett, brings a formidable pedigree. They previously steered Colony Homes, a builder that also catered to the entry-level market, to great success before its sale to KB Home in 2003. The disciplined operating philosophy and integrated "SMART Builder" system they developed at Colony are the very same ones driving Smith Douglas today, promising swift construction cycle times and minimal waste.

Finally, this all culminates in an impressive growth trajectory. For the full year 2024, the company reported a 25% increase in home closings and a 28% jump in home closing revenue, seemingly validating the entire strategy. A new public company, with seasoned management, a smart business model, and a foothold in America’s most dynamic regions, delivering robust growth. On paper, it is an almost perfect story.

However, the sturdiest of business models can conceal hidden dependencies. The land-light strategy, whilst brilliant in its capital efficiency, outsources a critical component of the supply chain. Smith Douglas is not a master of its own destiny when it comes to land; it is fundamentally reliant on the continued health and liquidity of its third-party land development partners. Should a credit crunch or a sector-specific downturn afflict these developers, the pipeline of finished lots could constrict or become prohibitively expensive overnight. The company’s growth engine is therefore tethered to factors entirely outside of its direct control. This is the first hint that the foundations of this investment case may not be as solid as they first appear.

Cracks in the Foundation

An investor looking solely at the full-year 2024 results or the headline figures from the first quarter of 2025 could be forgiven for their optimism. A 19% year-over-year increase in home closing revenue for Q1 2025 certainly looks healthy. Yet, for the discerning analyst, this is a classic case of driving whilst looking in the rear-view mirror. The revenue being celebrated today is the fruit of sales made in previous, stronger quarters. A forensic examination of the company’s forward-looking metrics reveals a far more troubling picture, one where the powerful growth engine has begun to sputter and stall.

The most immediate sign of distress is the erosion of profitability. Home closing gross margin, a critical measure of a builder's core operational health, fell to 23.8% in the first quarter of 2025, a significant decline from 26.1% in the same period a year prior. Management themselves attribute this squeeze to two persistent pressures: higher average lot costs and, more revealingly, rising sales incentives. Incentives as a percentage of revenue ticked up from 4.5% to 4.7%, with the company noting that the average over the trailing 13 weeks was north of 7%. This is a clear admission that in the current market, Smith Douglas is having to pay up to secure its sales, directly eating into its profits. The narrative of efficiency perfectly offsetting market headwinds is beginning to fray.

More alarming, however, are the indicators of future revenue. Whilst closings were up, they reflect past successes. The engine of new business, measured by net new home orders, seized up in the first quarter. The company recorded 768 net new orders, almost perfectly flat with the 765 orders from Q1 2024. For a company whose entire investment thesis is predicated on growth, stagnation is a deeply worrying sign. CEO Greg Bennett conceded as much in the earnings call, noting that "sales conversions were negatively impacted by affordability concerns and macro uncertainty".

This stagnation has had a calamitous effect on the company’s backlog, which represents its pipeline of contracted future revenue. At the end of March 2025, the number of homes in backlog had plummeted to just 791, a stark drop from 1,110 a year earlier. The value of this backlog fell even more precipitously, to $270 million from $381 million. This is not a minor dip; it is a collapse in future revenue visibility. It signals that the strong revenue growth reported in Q1 is not sustainable and that the coming quarters are likely to look very different.

This operational slowdown is now beginning to manifest on the balance sheet. After its IPO, the company boasted a fortress-like financial position. Yet, by the end of Q1 2025, some cracks have appeared. Debt-to-book capitalisation, whilst still low, jumped from a negligible 0.8% at the end of 2024 to 9.5% just three months later. Over the same period, cash on hand nearly halved, falling from $22.4 million to $12.7 million. Most concerningly, net cash used in operating activities ballooned from $9.3 million in Q1 2024 to $34.9 million in Q1 2025. The company is burning through more cash to generate stagnating new business.

Taken together, these data points paint a picture of a business facing a rapid reversal of fortune. The strong backward-looking metrics like year-over-year revenue growth create a dangerous illusion of health, one that could trap an unwary investor. The reality, as evidenced by the flat orders, collapsing backlog, and deteriorating margins, is that the business environment has turned hostile, and the company’s performance is suffering as a result. The true test of this business will not be the results it posted for Q1, but the results it will post in the second and third quarters of 2025, when the reality of a much smaller backlog translates directly into lower closings and weaker revenue.

Navigating the Headwinds

The operational cracks appearing at Smith Douglas are not occurring in a vacuum. They are being forced open by a pincer movement of macroeconomic pressure and intensifying competition. The entire US housing market is grappling with a new reality, and SDHC finds itself directly in the path of the storm.

The primary headwind is, without question, the affordability crisis, exacerbated by stubbornly high mortgage rates. While there is some hope for modest rate relief, most forecasts suggest that the 30-year mortgage rate will remain elevated, likely hovering above 6% through 2025. This has a chilling effect on the entire market, but it is particularly punishing for the entry-level buyers that constitute SDHC's core clientele. These are the households most sensitive to monthly payments, and every basis point increase in mortgage rates pushes homeownership further out of reach. The scale of the problem in the company's home turf is stark: in the Southeast, the estimated household income required to afford a typical single-family home is around $168,000, whilst the average two-earner household brings in only about $115,000. This is the mathematical reality behind the "affordability concerns" that management has acknowledged.

Simultaneously, the cost side of the ledger offers little respite. Lumber prices, a key input for any homebuilder, have remained volatile and stubbornly above pre-pandemic levels, subject to spikes from supply chain disruptions and timber shortages. A more ominous and perhaps underappreciated threat looms in the form of trade policy. Analysts are forecasting that duties on Canadian softwood lumber, a critical source of US supply, could double to around 30% in the summer of 2025. Such a development would inflict a severe blow to margins across the industry, a pressure that a builder like Smith Douglas, already experiencing margin compression, can ill afford.

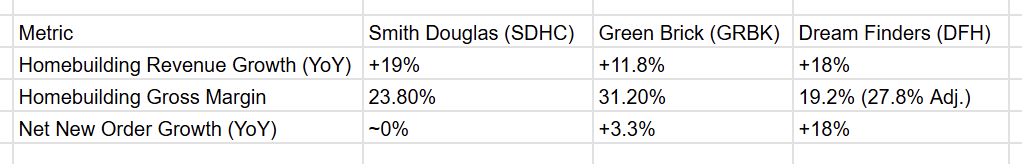

In a challenging market, the question for an investor becomes not just whether a company can survive, but whether it can outperform. It is here that a comparison with its peers becomes illuminating. By benchmarking Smith Douglas against other builders with a significant presence in the Southeast, such as Green Brick Partners (GRBK) and Dream Finders Homes (DFH), we can discern whether its struggles are purely market-driven or indicative of company-specific weaknesses

The data in this table tells a compelling story. Whilst all three builders are posting double-digit revenue growth, a reflection of the strong sales environment of late 2024, their current performance and profitability diverge significantly. Green Brick Partners posted a homebuilding gross margin of 31.2%, a figure that dwarfs SDHC's 23.8% and suggests a superior land acquisition strategy or more effective cost controls. Even more telling are the forward-looking metrics. Dream Finders Homes reported a blistering 18% year-over-year increase in net new orders, indicating its product and sales incentives are resonating powerfully with buyers in the current climate. In contrast, Smith Douglas’s new orders were flat. This comparison makes it difficult to attribute SDHC’s woes solely to a tough market. When the tide goes out, you see who is swimming naked, and at present, Smith Douglas appears to be navigating these challenging waters less effectively than some of its key rivals.

A Vote of Confidence or a Sign of Stress?

n 28 May 2025, the Board of Directors authorised a stock repurchase programme for up to $50 million of its Class A common stock. CEO Greg Bennett stated the move "underscores the Board and Management's belief that at times our share price may be undervalued relative to our long-term opportunity". This is the official narrative: a confident management team taking advantage of a market mispricing to generate shareholder value. Recent insider purchases by directors and executives in May add weight to this argument, representing a tangible vote of confidence from those who know the business best.

A more sceptical observer, however, might view this capital allocation decision through a different lens. This $50 million commitment, which could retire over 5% of the company's public float, comes at a curious time. As established, the company’s cash position has dwindled, its use of cash in operations has accelerated, and its leverage has ticked up. It is simultaneously in the process of expanding its credit facility to support its growth. Growth requires capital. Weathering a downturn requires a strong balance sheet. Why, then, divert a significant amount of capital to buying back shares?

One interpretation is that this is a classic act of financial engineering. With the knowledge that the collapsing backlog will lead to weak earnings reports in the coming quarters, the buyback serves two purposes. It creates an artificial source of demand for the stock, helping to prop up the price. It also sends a powerful signal of confidence to the market, potentially cushioning the blow when the inevitable bad news arrives. It could be seen not as a deployment of excess capital, but as a strategic use of the balance sheet to manage investor perception through a difficult period. For a company whose valuation is based on trailing earnings, a buyback can appear attractive, but for one facing a sharp decline in future earnings, it may prove to be a costly and ill-timed decision.

We have also seen a large number of insider buys since May 2025, signalling insiders seem to believe the company is currently undervalued. The price is currently below the most recent purchases, meaning opening a new position now would yield a better share price then even insider purchases.

The Final Verdict

In assessing Smith Douglas Homes, one is confronted with two conflicting narratives. The first is a compelling long-term story of a well-run company with a proven management team, a disciplined and capital-efficient business model, and a strategic focus on the most resilient segments of the nation's fastest-growing housing markets. The insider buying and the share repurchase programme are presented as evidence that management sees deep, unrecognised value.

The second narrative is one of clear and present danger. It is a story of rapidly compressing margins, a sales engine that has ground to a halt, and a collapsing backlog that points towards significant revenue and earnings weakness in the near future. These internal problems are being amplified by a hostile macroeconomic environment of high interest rates and profound affordability challenges. Crucially, the company appears to be underperforming its direct competitors, suggesting its issues are not merely cyclical.

The prudent conclusion is that whilst the long-term strategic blueprint for Smith Douglas may be sound, the near-to-medium term outlook is fraught with peril. The market, as evidenced by the wave of analyst downgrades, is slowly awakening to the disconnect between the company's past performance and its future prospects. However, the full impact of the housing slowdown has yet to be reflected in the company's reported financials or, arguably, its stock price.

Therefore, Smith Douglas Homes is an investment to be avoided for now, but one that merits a place on a discerning investor's watchlist. The combination of a shrinking backlog and margin pressure is highly likely to produce a series of disappointing quarterly reports for the remainder of 2025. This could, and probably should, drive the share price lower. The current valuation does not appear to adequately discount this near-term pain.

The true test of Mr. Bradbury and Mr. Bennett's lauded operational skill will not be how they performed in the boom years, but how they navigate this downturn. The advice for the thinking investor is to remain on the side-lines, to wait for the storm to fully break, and to observe how the ship is steered through the turbulent waters ahead. Only then, perhaps at a much more attractive price, will it be clear whether Smith Douglas Homes is a genuine long-term compounder or simply another cyclical builder that enjoyed a strong run in a favourable wind.