Disclaimer: This is in no way financial advice. I am not a financial advisor. Do your own research before making any final decision on investments.

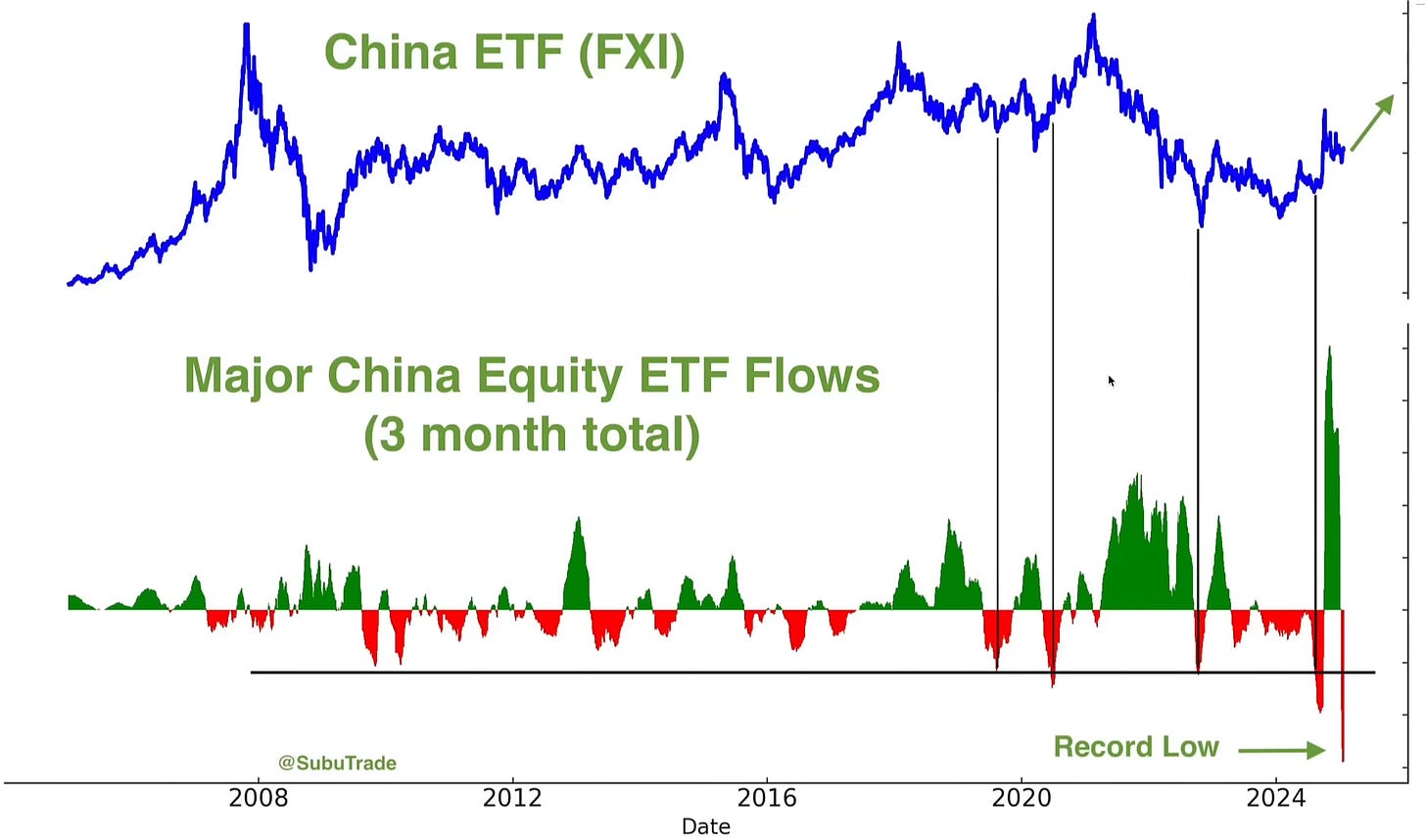

There is currently a lot of fear surrounding Chinese Stocks. In recent years, the Chinese government has intensified regulatory scrutiny across various sectors, including technology and real estate. This has led to increased uncertainty and caution among investors, contributing to the underperformance compared to the US market.

Ongoing trade disputes, particularly with the United States, have also introduced volatility and unpredictability into the market. Recent U.S. tariffs and China's reciprocal measures have further strained relations, prompting global investors to adopt a more cautious stance toward Chinese equities.

However with the US market becoming more and more overvalued by the day, and with the extremely low valuations on Chinese companies, it is in my opinion a good idea to have at least a little expose to China when building a well-rounded portfolio. Today I want to share my favourite company to maximise benefit and minimise risk when dealing with Chinese companies.

JD.com (Ticker: JD)

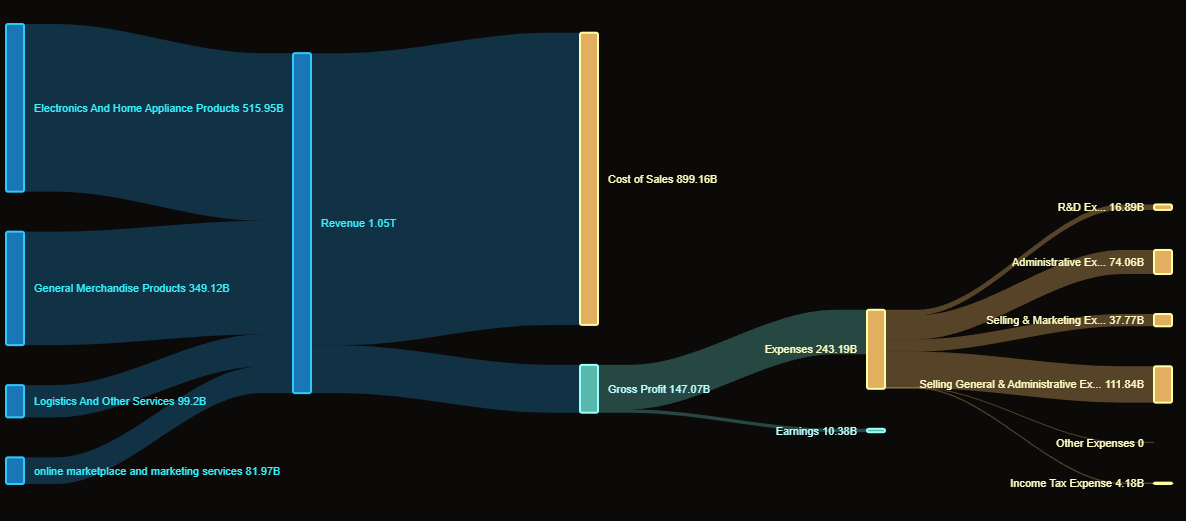

JD.com, Inc. operates as a supply chain technology and service provider in the People’s Republic of China (PRC). The company offers computers, communication, consumer electronics products, home appliances, and general merchandise products including food, beverage, furniture, household goods, cosmetics, pharmaceutical and healthcare products, industrial products, books, and many more different items.

It also provides online marketplace services for third-party merchants including marketing services and omni-channel solutions to customers and offline retailers, as well as online healthcare services.

The company also develops, owns, and manages its logistics facilities and other real estate properties to support third parties, offers asset management services and integrated service platform, leases storage facilities and related management services, and engages in online retail business.

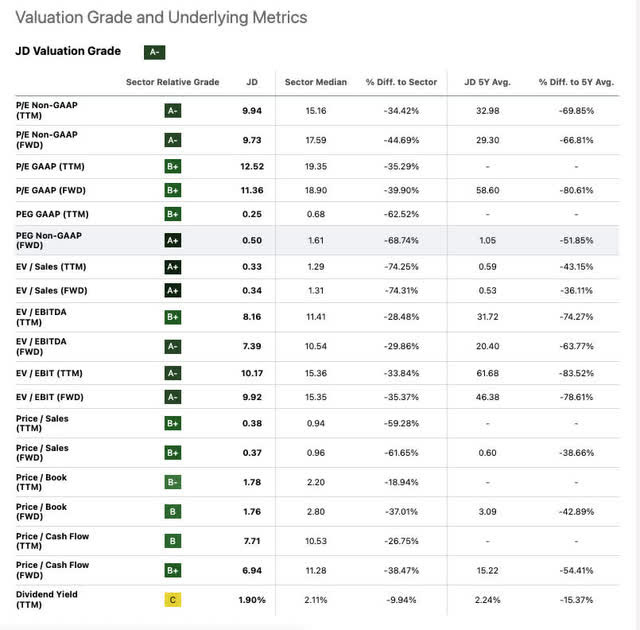

This is obviously an extremely large and well diversified business, with it’s many different segments contributing to it’s 2023 revenue of over $159 Billion. This puts JD.com at a Price/Sales multiple of 0.37x - insanely low. Obviously not all of this revenue is profit, in fact ‘only’ $4.79 Billion of it is, however this still creates a Price/Earnings ratio of 12.2x and an EV/EBITDA of 8.19x - in a sector where the average is 16x. This is extreme undervaluation.

Why is it So Undervalued?

Walmart recently sold its entire 5% stake in JD.com for $3.6 billion, following Tencent’s earlier divestment, raising concerns about the company's long-term prospects. JD.com faces stiff competition from both Alibaba and PDD as well, with forced it to adopt much more aggressive pricing strategies which have squeezed profit margins.

China's broader economic slowdown has further weakened consumer spending, with JD.com reporting only a 1.2% revenue increase in a recent quarter. While the company recently reported very strong earnings, the stock has struggled to gain momentum, most likely due to scepticism around China's economic comeback and JD.com’s ability to maintain it’s current growth.

JD.com’s logistics-heavy business model, which requires significant capital investment, limits its ability to generate high Free Cash Flow when compared to other asset-light competitors. China's economic slowdown and weakened consumer spending have also slowed revenue growth, U.S-China tensions and regulatory uncertainty have also created extremely negative investor sentiment.

So Why Am I Buying into China?

Extreme fear now surrounds Chinese assets, as shown by the enormous levels of selling of FXI, the Chinese market ETF. This reminds me of my favourite investing quote of all time: “be fearful when others are greedy and be greedy only when others are fearful.”

Combine this with the extreme overvaluation of U.S. markets and I think now is a good time to start looking for exposure in international markets.

So Why JD.com?

Extremely Cheap Valuation

At today’s price of around $40 per share, the stock is priced like JD.com is a struggling business, which seems completely ridiculous when you look at it’s earnings. The company is making more money, cutting more costs and buying back more stock every year, yet the market has simply turned a blind eye.

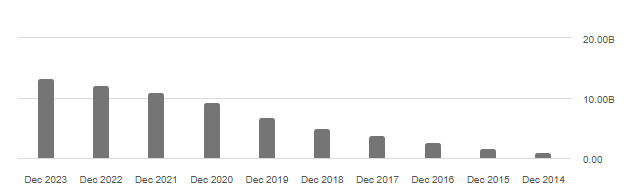

Looking at the most recent earnings report, Revenue grew 5.1% YoY which is great given all the negative sentiment around the state of China’s economy. More importantly, profits are rising much faster than sales because of massive cost-cutting and greater efficiency initiatives. Operating income increased 29.5% and net income 47.8%! This is not a struggling business in the slightest.

On top of all this JD is aggressively buying back shares. $5 billion worth will be repurchased over the next few years - almost 9% of the current market cap. This signals management thinks the business is currently undervalued, and I always love to see this in a company.

Strong and Healthy Business

In my opinion, JD.com is grouped with other Chinese stocks a lot of the time and people assume it’s struggling, but that is simply not true. The company is growing, improving margins and generating a lot of Free Cash Flow. It also has $28 Billion in cash, which is certainly nothing to scoff at.

The biggest reason for the tiny valuation in my opinion comes from the fact that JD is still seen as a low-margin e-commerce business. However this is no longer the case. Margins are expanding, logistics are improving, and there is still enormous room to run. The company stands to gain so much from Artificial Intelligence advancement, through improvements to warehouse efficiency, distribution networks, targeted advertisement and business expansion the seems to be almost limitless potential at the moment. This means the company is set for long-term stability and growth, which is extremely attractive to me.

Amazing Risk/Reward

If the company keeps improving margins and executing buybacks, the stock could easily hit $70 in the next 12-18 months which is a 75% gain. Even in a more moderate scenario where JD just keeps doing what it’s doing the stock should be worth at least $50 a 25% gain. A DCF valuation of the stock yields a fair value of around $80, although this seems unlikely given the geopolitical risk. Still it is telling the stock would most likely more than double overnight if it was in the USA.

The only real downside scenario is if China’s economy completely collapses. Even if this extremely unlikely scenario takes place, JD’s strong cash position should keep it from falling much below $35. That means the worst-case downside is only about 12% while the upside is 50-75% and even more. That’s a great risk-reward setup in my eyes.

Conclusion

I will start to build a position in JD.com from today, and I intend to keep buying when possible as long as the stock is cheap. Given how undervalued it looks at the moment, it may be quite a while before I stop buying! Let me know if you agree with my analysis, and have a great day!