Unity Software - A Money Incinerator

While AppLovin prints money, Unity burns it. A deep dive into a broken growth cycle, toxic dilution, and the erosion of developer trust.

In my last company analysis, I discussed AppLovin and described it as a money printer - a company that had perfected the conversion of data into cash flow. Today we turn our attention to Unity Software. If AppLovin is a money printer, Unity is a furnace. It takes shareholder funds and developer trust, and burns them.

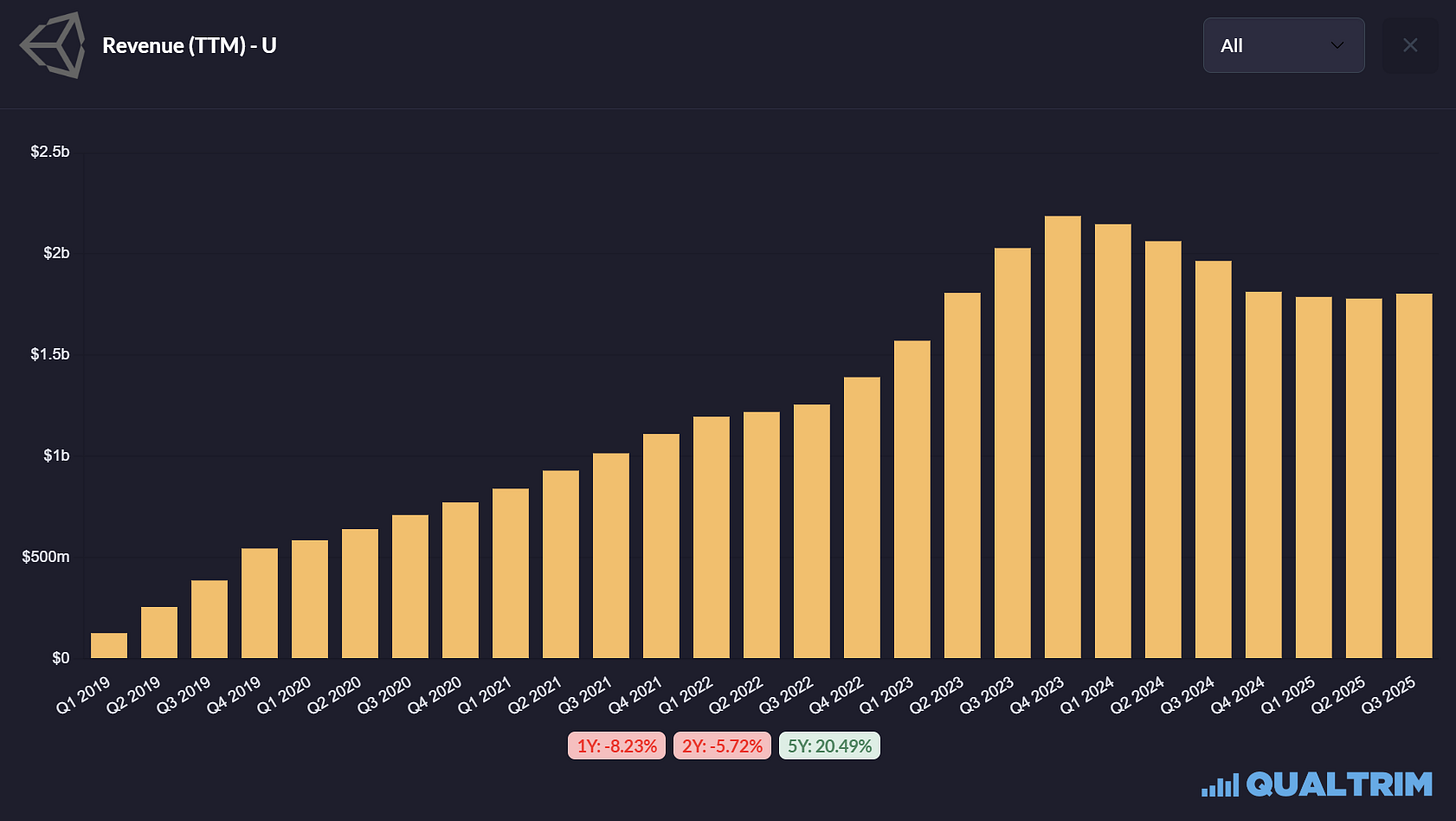

The investment case for Unity is that by owning the game engine that powers half the world’s games, Unity possesses unique data that fuels an unbeatable advertising machine. In turn, that advertising machine subsidises the engine, creating a cycle of growth and democratisation. In January 2026, we can state with high confidence that this cycle is broken. The game engine is losing ground to competitors on both the high and low ends of the market. The advertising business is being beaten by AppLovin. And the financial structure of the company has turned into a vehicle for transferring wealth from shareholders to employees through excessive stock-based compensation, or SBC.

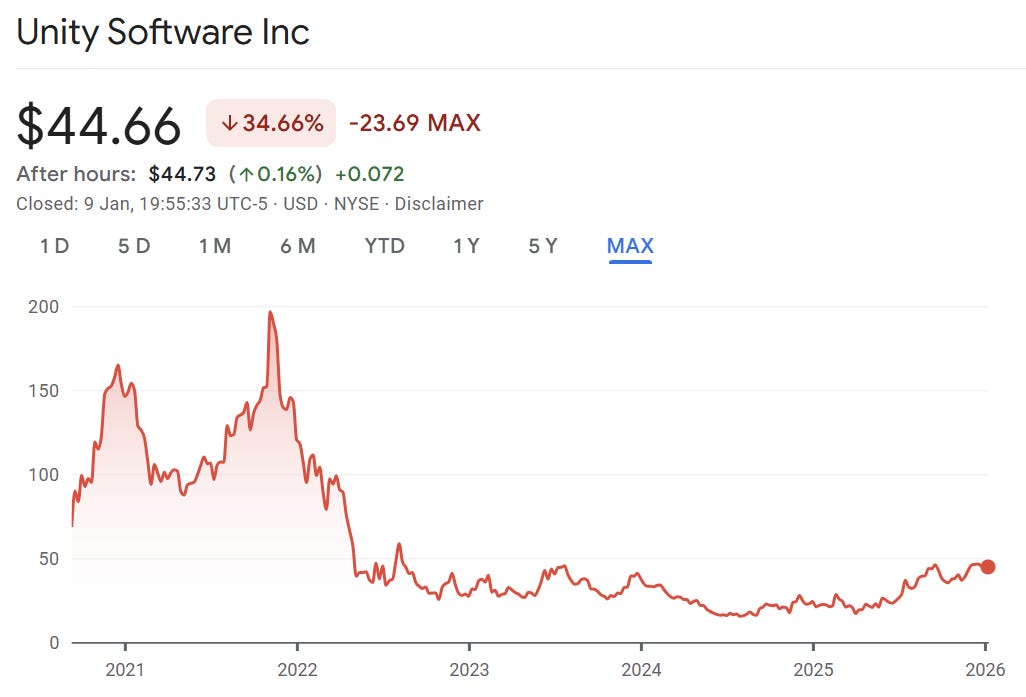

Unity is trading at ~$45. This price assumes that the company is a high-growth software monopoly. The reality is that Unity is a low-growth ad-tech firm attached to a capital-intensive software business, growing its top line at only 5% while diluting its shareholders at a rate that makes long-term ownership pointless.

Subscribers receive the complete analysis below, including the DCF model, a close look at management and their strategy, and the price I would buy this company myself. If you are serious about understanding Unity, I suggest you subscribe to the full report.

The Create Segment

The core of Unity’s identity has always been the Create division - the game engine itself. For over a decade, Unity enjoyed a monopoly on mobile and indie game development. It was the default choice. That default status is now under threat.

The Runtime Fee

Unity saw a series of catastrophic events in September 2023. Management introduced the ‘Runtime Fee’, a retroactive charge on game installations that would have forced successful developers to pay Unity for every new user, regardless of revenue. The proposal was more than a price hike. It was a violation of the agreement between a toolmaker and its users.

Although the fee was eventually cancelled and replaced with a traditional seat-based subscription model in late 2024, the damage was permanent. Trust is non-renewable in the software business. Developers who had spent years learning C# and building their pipelines around Unity realised that their business models existed at the whim of Unity’s management. Developers moved quickly to diversify their risk.

Throughout 2024 and 2025, we observed a significant migration of the developer pipeline. Established studios with live games remained on Unity because the cost of switching is prohibitive. But new projects - the hits of 2027 and 2028 - began to shift. The primary beneficiary at the lower end has been Godot, an open-source engine that carries no corporate risk.

Godot’s user base doubled in the eighteen months following the Runtime Fee announcement. While Godot lacks the advanced features of Unity, it has become the new standard for the hobbyist and indie segments that used to be Unity’s nursery.

At the high end, the situation is equally grim. Unity has spent years trying to break into the AAA console and PC market, promising graphical quality that rivals Epic Games’ Unreal Engine. This effort has failed. Unreal Engine 5 has established a seemingly insurmountable lead for high-end games. When a major studio plans a PlayStation 6 or high-end PC title in 2026, Unreal is the default choice. Unity is left in the middle - too expensive and risky for the small indie, and not powerful enough for the massive AAA studio.

Pricing Power

In January 2025, Unity implemented a significant price increase to compensate for the cancellation of the Runtime Fee. The cost of a Unity Pro subscription rose 8% to $2,200 per seat, while the Enterprise tier saw a 25% hike.

Bulls will argue that this demonstrates pricing power. I believe it demonstrates desperation. A software company with true pricing power raises prices because it adds value. Unity raised prices because it failed to monetise its user base through the promised ad-tech synergies. The revenue growth in the Create division for Q3 2025 was only 3% YoY. When you adjust for the price hike, this implies that the actual volume of paid seats has likely flattened or declined. The company is extracting more money from a shrinking or stagnant pool of customers. This is the classic behaviour of a company in decline, not a growth stock.

Technical Debt and Unity 6

The release of Unity 6 in late 2024 was supposed to be a stabilisation release, helping the engineers who had suffered through years of buggy features and half-finished tools. Management announced that download numbers for Unity 6 reaching 9.4 million.

Investors should view these numbers with scepticism. Downloads are not a metric we should care about at all. A student downloading the free version to pass a class counts as a download. A bot farm downloading the engine counts. The only metric that matters is revenue, and as noted, Create revenue is barely moving.

The reality is that Unity is drowning in technical debt. For years, the company pursued an acquisition strategy that bolted tools onto the game engine without properly integrating them. The result is a fragmentation. There are currently three different render pipelines, each incompatible with the others. There are two different physics engines. There are two different input systems. A developer starting a project in 2026 faces a bewildering array of choices, where picking wrong can lead to a dead end months later.

In contrast, Godot offers a unified and more lightweight experience, and Unreal offers a coherent, heavy, integrated suite. Unity’s product strategy is a reflection of its corporate structure - a collection of silos that do not talk to each other.

The Grow Segment

The second part of Unity is the Grow division, which encompasses its ad network and mediation platform. This division generates the majority of the company’s revenue, making $318 million in sales in Q3 2025. The narrative is that Unity’s ad tech is a market leader. The numbers suggest otherwise.

AppLovin vs Unity

I talked about AppLovin recently, you can read that article here.

The mobile advertising market is a zero-sum game played by algorithms. The winner is the platform that can predict with the highest accuracy which user will click on an ad and install an app. Unity is being slaughtered by AppLovin.

In Q3 2025, AppLovin reported revenue growth of 68%. Unity’s Grow division grew by 6%.

This is not an anomaly either. It is the result of a technological gap. AppLovin’s AXON 2.0 engine uses predictive AI which optimises ad campaigns in real-time. Advertisers pouring money into user acquisition campaigns have found that a dollar spent on AppLovin returns significantly more value than a dollar spent on Unity.

Unity’s answer to AXON is a product called Vector. Launched in 2024, Vector was supposed to close the gap. It hasn’t. Feedback indicates that Vector campaigns require ten to twelve weeks to optimise. In the fast-paced world of mobile gaming, where a game’s launch weekend can determine its fate, a three-month learning period is unacceptable. AppLovin’s system optimises almost instantly.

Data

The failure of Vector reveals that the idea of the accelerating cycle between the Create and Grow segments was flawed from the start. Unity believed that having contextual data from the game engine, for example knowing a player is stuck on Level 5 of Candy Crush, would be amazing ad targeting.

It turns out that contextual data is less valuable than transactional data. AppLovin does not own a game engine. It owns a mediation platform and a massive portfolio of first-party games that generate transaction signals. Knowing that a user just spent $5 on a coin pack is infinitely more useful for advertisers than knowing they are playing a specific level. By focusing on the engine data, Unity optimised for the wrong variable.

IronSource Failure

Unity purchased IronSource for $4.4 billion in 2022 to fix its ad tech stack. Three years later, the companies are still operating like two warring tribes.

The legacy Unity team, based in the US and Denmark, prides itself on engineering and toolmaking. The IronSource team, based in Israel, is driven by aggressive sales and monetisation. Instead of blending these cultures, Unity has allowed them to stay in opposition.

The integration of the two ad stacks has been painfully slow. As of late 2025, Unity was still maintaining separate data pipelines for Unity Ads and IronSource. The CEO has promised that 2026 will be the year these stacks finally merge, but the market has moved on. While Unity spent three years trying to glue two incompatible backends together, AppLovin spent three years refining its AI models. The gap is now likely too wide to close.

Financial Engineering and Dilution

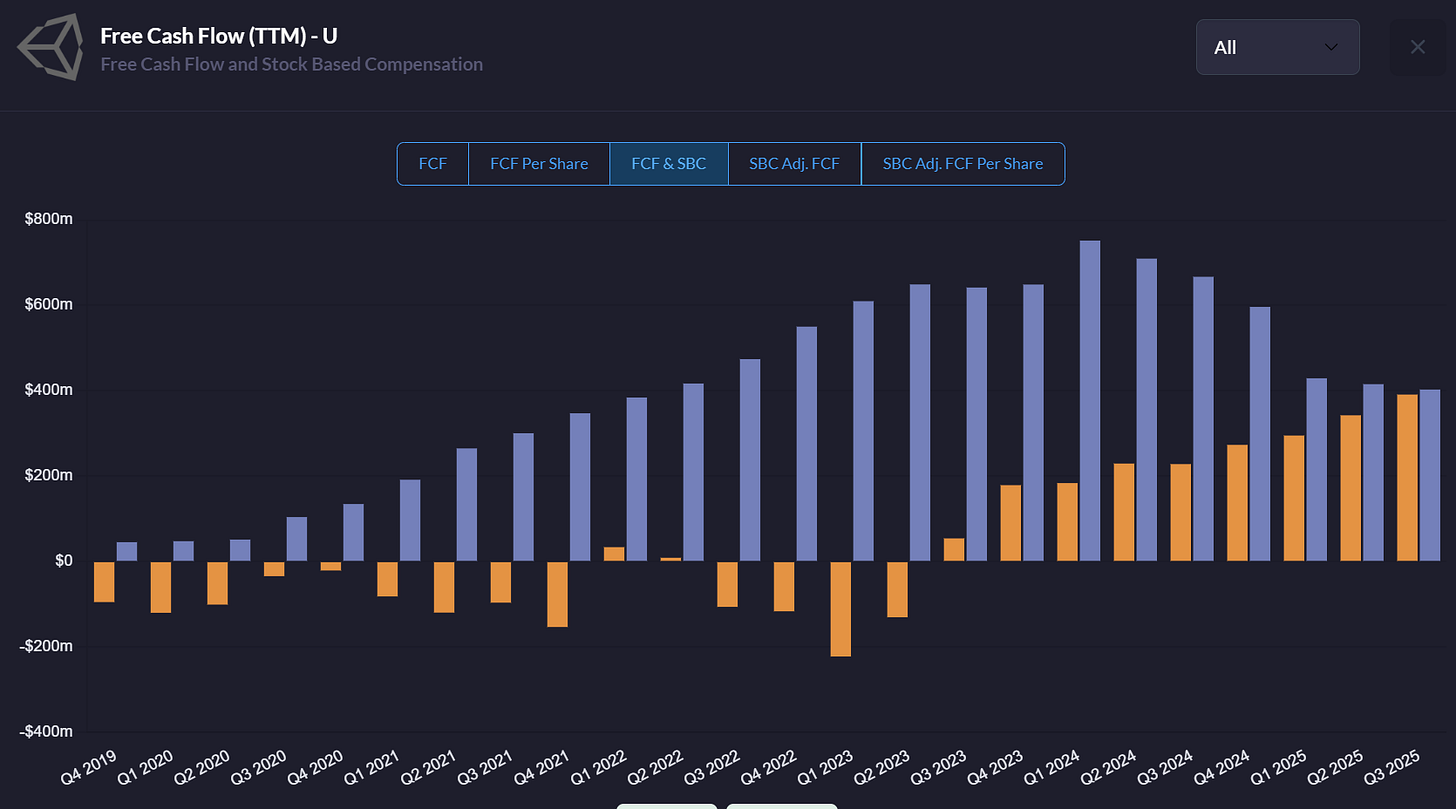

If the operational failures are concerning, the financial picture is horrifying. Unity Software issues a ridiculous amount of SBC, creating a headwind that makes shareholder value creation nearly impossible.

The SBC Addiction

In the technology sector, it is common to use SBC to attract talent. However, there is a difference between using equity as an incentive and using it as a substitute for an actual business model. Unity falls into the second category.

For the twelve months ending 30 September 2025, Unity incurred $515 million in SBC expense. The company’s total revenue over the same period was approximately $1.8 billion.

Unity is spending an amount equivalent to 29% of its revenue on paying its employees in stock. This is terrible. A healthy software company might spend 10% of revenue on SBC. Unity’s figure shows that the company’s business model is broken. It effectively survives by printing equity to pay its bills, disguising true operating costs as ‘adjustments’.

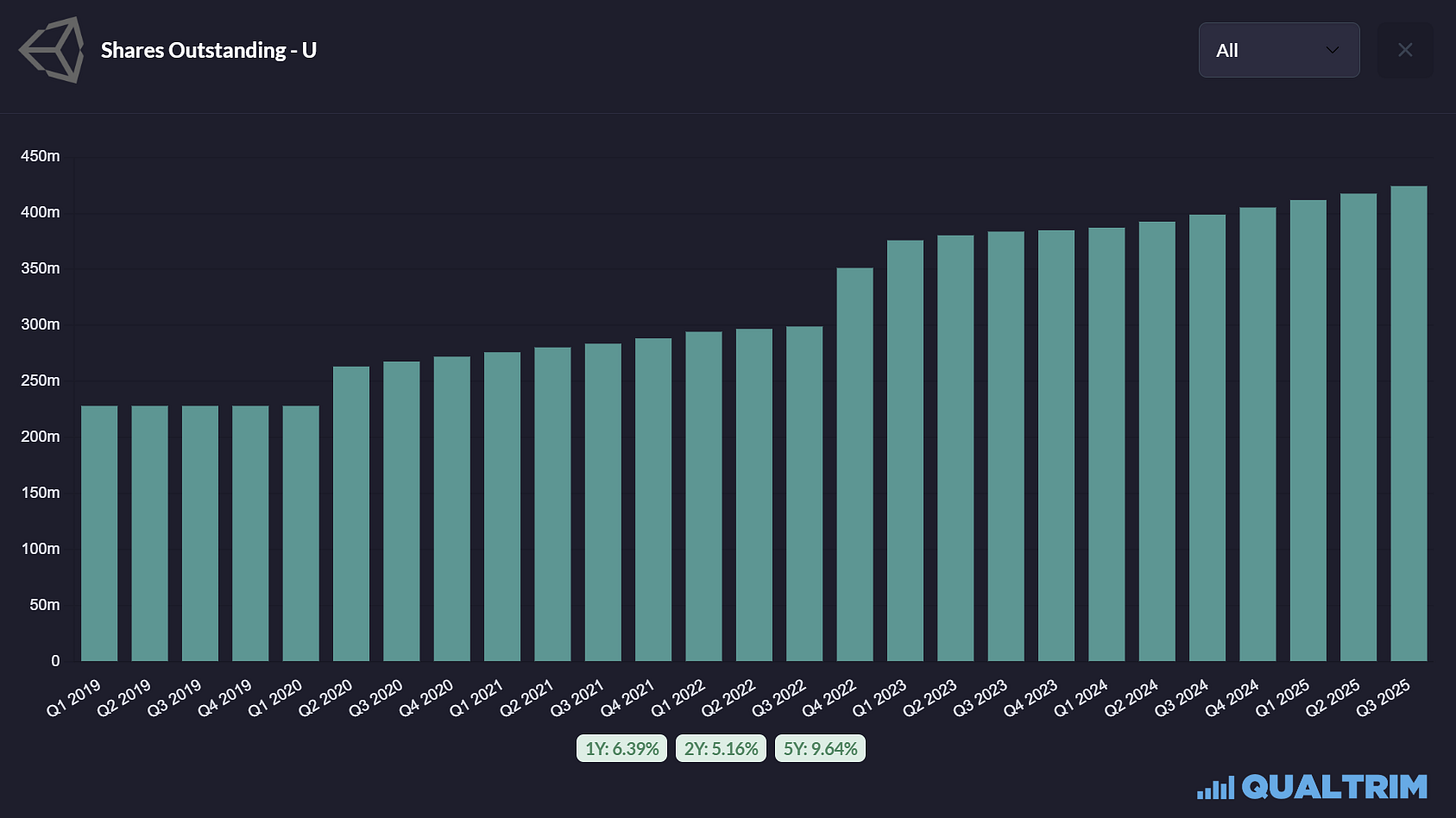

Dilution

The result of this addiction is massive dilution for you, the shareholder. At the time of its IPO in 2020, Unity had 263 million shares outstanding. As of January 2026, that number is 428 million.

This is dilution of over 60% in five years. If you bought a 1% stake in the company at the IPO and held it, you now own ~0.6%. The company has to grow its enterprise value by 60% just to get your share price back to where it was 5 years ago.

Management has pledged to reduce SBC in 2026, but we have heard these promises before. The reliance on equity is baked into the compensation packages of thousands of employees. Reducing it would likely trigger a mass departure of talent - talent that is already demoralised by the layoffs and strategic confusion.

Reality

Unity management prefers to discuss Adjusted EBITDA, a metric that conveniently adds back the billion dollars of stock compensation. In Q3 2025, they reported an Adjusted EBITDA of $109 million.

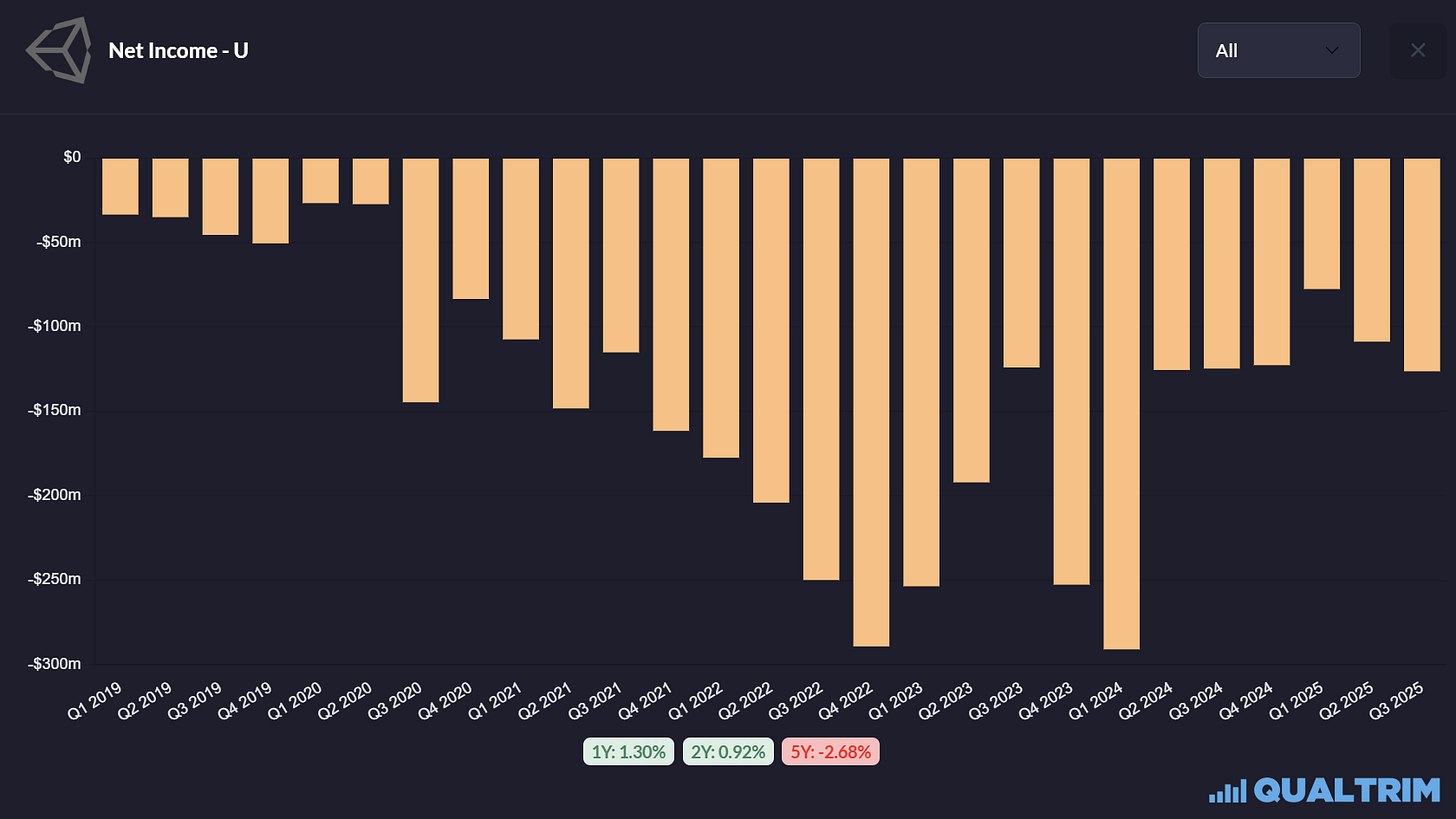

This number is fiction. It treats employee compensation as if it were not a real expense. When we look at the GAAP Net Loss, Unity lost $127 million in the quarter. The company is not profitable. It has never been profitable. And given the SBC load, it is unlikely to be profitable on a GAAP basis for years.

Market Landscape in 2026

The broader market context for Unity provides no relief. The gaming industry is hollowing out, disproportionately affecting Unity’s core customer base.

The Squeeze on the Middle

The gaming market is splitting in half. At the top, you have massive live-service ecosystems like Fortnite, Roblox, and Grand Theft Auto. These games generate the majority of industry revenue, and they do not use Unity.

At the bottom, you have the casual and simple indie games. This segment is under pressure from the saturation of the mobile market. Furthermore, as discussed, this segment is increasingly moving to Godot to save costs.

Unity’s sweet spot was the ambitious but not massive titles. This is the segment of the market that is shrinking the fastest. Venture capital funding for mobile gaming startups has dried up. Fewer startups mean fewer Unity seats sold.

Regulation

Some bulls point to the Digital Markets Act in Europe and similar regulations in Japan as a tailwind for Unity. The logic is that as Apple and Google are forced to open their app stores, Unity can offer third-party billing and store solutions.

This is false. The primary beneficiary of open app stores has been Epic Games, which has the consumer-facing brand and the content to drive store adoption. Unity is a B2B infrastructure company. It has no relationship with gamers. It cannot drive traffic to a third-party store. It can only provide the plumbing, which is a low-margin commodity.