Unity Software: An Engine in Mid-Reboot

An In-Depth Analysis

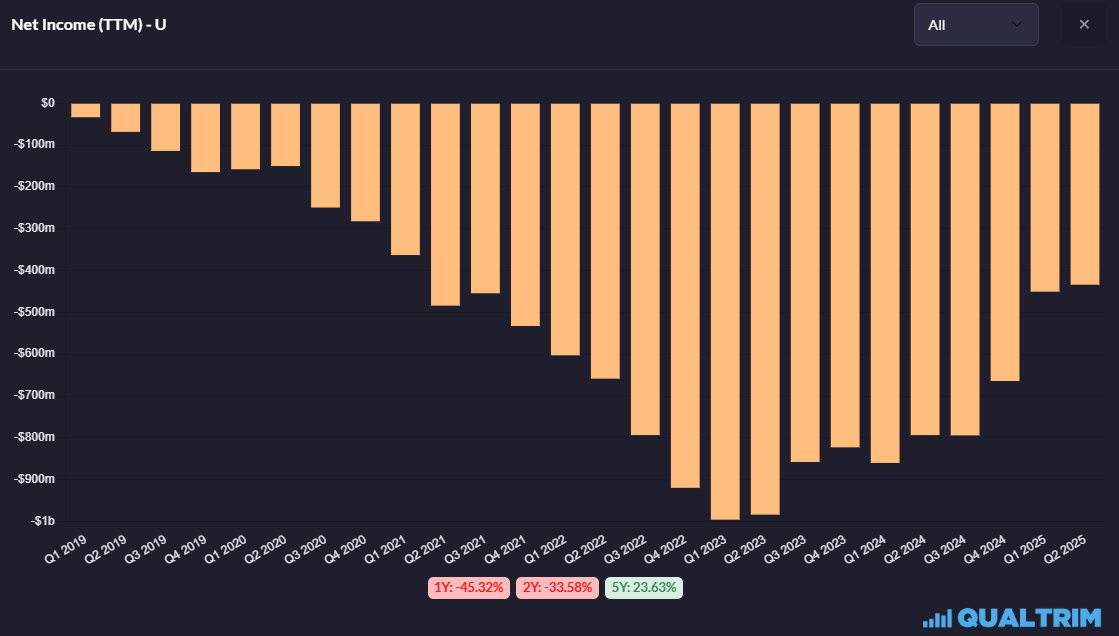

When a new chief executive takes the helm of a company that has consistently bled red ink since its inception, the market listens intently to their first pronouncements. For Unity Software, that moment came with its second-quarter results for 2025. Matthew Bromberg, the new President and CEO, declared that the quarter would be remembered as an "inflection point in the Unity story". It is a bold claim for a company that has never achieved sustained profitability, reporting significant net losses year after year, including a staggering $921 million loss in 2022 alone. For long-suffering investors, the question is whether this is the genuine start of a sustainable turnaround or merely a temporary reprieve driven by the brutal but necessary cost-cutting of the past year.

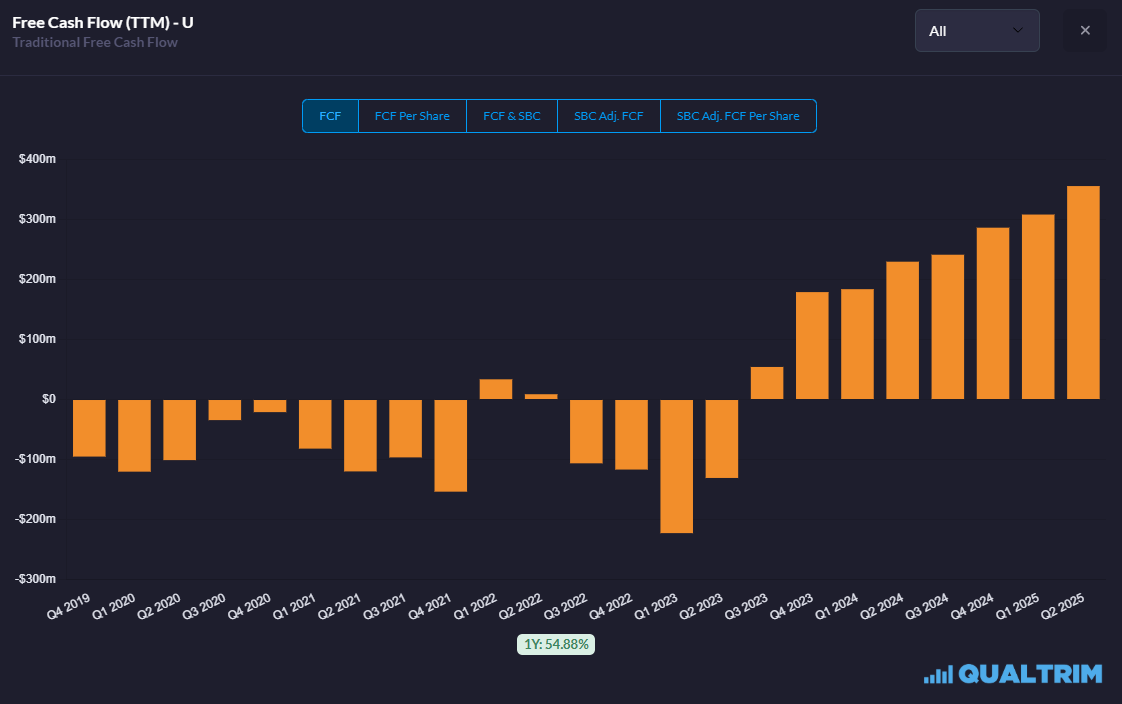

The context for this claim is a company in the throes of a profound identity shift. For years, Unity pursued a strategy of growth at all costs, expanding its reach and acquiring new technologies while shareholder value languished. The recent financial reports, however, tell a different story. The declared inflection point is not one of a sudden return to blistering top-line growth; in fact, Q2 revenue was $441 million, a slight decline of 2% from the $449 million recorded in the same period a year prior. The real narrative, the one that underpins Bromberg's confidence, is found deeper within the financial statements. It is a story about a pivot from an undisciplined pursuit of market share to a focused drive for operational efficiency and, most importantly, profitability. The evidence lies in metrics like free cash flow, which surged to $127 million, a remarkable 59% increase year-over-year. This suggests a fundamental change in the company's philosophy, a newfound discipline that could finally make Unity's powerful position in the gaming world translate into tangible returns.

Unity's Create and Grow Segments

To appreciate the scale of this turnaround attempt, one must first understand the intricate machine that is Unity's business model. The company operates through two distinct but deeply interconnected segments: Create Solutions and Grow Solutions.

Create Solutions is the very heart of the company. It is the world-renowned game engine, a digital workshop that provides developers with a comprehensive suite of software and tools to build interactive 2D and 3D content. This is the platform that powers a vast swathe of the digital world, from mobile games to architectural visualisations and automotive design simulations. Revenue here is generated primarily through a tiered subscription model. A free 'Personal' version democratises game development for hobbyists, while paid 'Pro' and 'Enterprise' plans cater to professional studios and large corporations, offering advanced features and dedicated support.

If Create is the workshop, then Grow Solutions is the global distribution and monetisation network. This segment, massively expanded by the controversial $4.4 billion all-stock acquisition of ironSource in 2022, is designed to help developers find an audience and make money. Its primary engine is Unity Ads, a platform that enables developers to integrate in-game advertising, turning player engagement into revenue.

The grand strategy was to create a self-reinforcing "flywheel." The ubiquitous Create engine would feed a constant stream of new games and apps into the Grow ecosystem. In turn, the immense data gathered from billions of players interacting with these apps would provide invaluable insights, helping to refine the Create tools and make the advertising network in the Grow segment more intelligent and effective. This virtuous cycle, in theory, should have been unstoppable. Yet, the company's persistent losses prove that simply owning the components of a flywheel is not enough. The machine never spun efficiently, hampered by flawed integration and a lack of focus. The ironSource acquisition was a costly bet to fix the Grow side of the equation, but the real failure was one of execution. This is the challenge the new leadership has inherited: not to invent a new strategy, but to finally execute the original one correctly.

The Painful but Necessary Reset

The path to the current "inflection point" was paved with turmoil. The company's relationship with its core developer community was severely damaged in 2023 by a disastrously communicated "Runtime Fee," a plan to charge developers each time a game was installed. The ensuing backlash was a public relations catastrophe that eroded years of goodwill and precipitated the departure of long-time CEO John Riccitiello.

His successors were left with no choice but to initiate what has been described as a "painful but necessary reset". This was not a minor course correction but a radical corporate restructuring aimed at survival and a return to the company's core principles. The first and most painful step was a drastic reduction in force, with approximately 1,800 employees, or 25% of the company's workforce, being laid off to align costs with the market reality.

Beyond the headcount reduction, the company began a "portfolio reset," a strategic amputation of non-core and distracting business units. This involved winding down lower-margin activities like professional consulting services, which had a direct and deliberate impact on the revenue of the Create segment. Perhaps the most telling move was the decision to discontinue the tools division of Wētā Digital, the high-end visual effects studio behind films like Avatar, which Unity had acquired for $1.63 billion just a few years earlier.

This signalled a clear retreat from ambitions in the film industry and an intense refocus on the core business of gaming. The year-over-year revenue declines reported in late 2024 and early 2025 were not a sign of a failing business, but the planned and accepted consequence of this strategic triage. Management consciously chose to shrink the company to save it, shedding the weight of unprofitable ventures to reveal what they hoped was a financially viable core. The subsequent emergence of strong positive free cash flow suggests this gamble is paying off, indicating that the core business of the game engine and ad network is indeed profitable, but its health was previously masked by the losses of the now-excised divisions.

Bromberg's Strategy and the 'Vector' Catalyst

Into this reset environment stepped Matthew Bromberg in May 2024. His background, with senior roles at gaming giants Zynga and Electronic Arts, represents a deliberate choice to install a leader with a deep, intrinsic understanding of Unity's core customer: the game developer.

Bromberg's strategy is one of focused simplicity. He has articulated a clear vision to concentrate Unity's efforts on serving its core gaming customers, leveraging AI to make game development faster and more efficient, and, crucially, to deeply integrate monetisation into the creation process, thereby fulfilling the original promise of the Create-Grow flywheel.

The centrepiece of this new strategy is Unity Vector, an AI-powered advertising platform rolled out in early 2025. Vector is the technological catalyst designed to reignite the Grow segment. It uses self-learning AI models to analyse data from across the Unity ecosystem, optimising ad campaigns to acquire high-value users and maximise return on ad spend for developers. The impact was immediate and profound. In its first full quarter of operation, Vector drove a 15% sequential increase in revenue for the Unity Ad Network, which now accounts for nearly half of all Grow Solutions revenue.

Vector is more than just a successful product launch. It represents the first tangible proof that the multi-billion-dollar ironSource acquisition can finally bear fruit. It is the technological bridge that connects the two halves of the flywheel, taking the vast data generated on the Create side and using sophisticated AI to make the Grow side dramatically more effective. Its success validates the thesis that by embedding AI effectively, first in advertising with Vector and later in development with tools like Unity AI , the company can build a formidable competitive advantage rooted in proprietary data and custom-trained models.

Navigating a Two-Engine Race

No analysis of Unity is complete without considering its formidable rival, Epic Games' Unreal Engine. For years, the narrative has been a simple head-to-head battle, but the reality is more nuanced. The two engines, while competitors, are increasingly leaders of distinct, albeit overlapping, market segments.

Unreal Engine is the undisputed powerhouse of the high-end, AAA gaming world. Favoured by large studios for its breathtaking graphical fidelity and the raw power of its C++ programming language, it is the engine behind many of the most visually stunning blockbuster games. Its business model reflects this focus, taking a 5% royalty on game sales after the first $1 million in revenue, a bet on sharing the spoils of massive hits.

Unity, by contrast, has built its empire on accessibility and scale. It is the dominant platform for mobile gaming, with over 70% of top mobile titles built on its technology. Its use of the C# programming language presents a gentler learning curve, making it the go-to choice for millions of indie developers, students, and creators working on 2D games or projects that require rapid prototyping. Unity's subscription-based model provides more predictable, recurring revenue streams, insulated from the hit-or-miss nature of the AAA games market.

In essence, the two companies are playing different games. Unreal is competing to create the next visual masterpiece, while Unity is competing to be the indispensable operating system for the entire long tail of digital content creation. Its business model is designed not to take a slice of a few massive successes, but to provide the essential tools and monetisation services to hundreds of thousands of smaller projects. While Unreal will continue to capture headlines, Unity is quietly embedding itself into the fabric of the broader digital economy, a strategy that is arguably more diversified, resilient, and, with its newfound discipline, potentially more profitable in the long run.

A Financial Deep Dive

The strategic narrative of a turnaround is compelling, but it must be validated by the financial data. A close examination of Unity's recent performance reveals clear signs that the reset is taking hold and the new strategy is gaining traction.

While the year-over-year revenue figures show declines directly attributable to the portfolio reset, the forward-looking indicators are more positive. The company comfortably beat its own revenue guidance in the second quarter and has issued stable guidance for the third quarter of $440 million to $450 million, suggesting that the revenue base has now bottomed out and is poised for a return to growth.

The most compelling part of the story is the dramatic improvement in profitability. The GAAP Net Loss, which stood at a colossal -$921 million for the full year 2022, had shrunk to just -$107 million by the second quarter of 2025. The key metric, however, is Free Cash Flow. The achievement of a strongly positive $127 million in Q2 2025 is the single most important proof point that the company has stabilised its operations. It demonstrates that the leaner, more focused core business is not only viable but can now generate enough cash to fund its own future investments without relying on external capital. This financial stability is further supported by a robust balance sheet, which showed a cash position of $1.7 billion as of 30 June 2025, providing a significant buffer to navigate the remainder of its transition.

The Investment Thesis

Weighing the evidence, the investment case for Unity Software has fundamentally changed over the past year. The bull and bear arguments are now clearer than ever.

The bear case rests on the company's chequered past. Unity has a long and unambiguous history of failing to deliver on its promises of profitability. Sceptics will rightly ask if this newfound discipline can last, or if the company will revert to its old habits once the immediate crisis has passed. The turnaround is still in its infancy, and the initial success of Vector could prove to be a flash in the pan. Execution risk remains high.

However, the bull case appears increasingly compelling. The company is now led by a credible, industry-native CEO who is executing a clear and logical strategy focused on the core gaming market. The painful but necessary restructuring is largely complete, leaving behind a leaner organisation with a demonstrably profitable core and, crucially, strong positive free cash flow. The launch of Unity Vector provides a powerful technological catalyst that is already reigniting growth in the vital monetisation segment, proving that the expensive ironSource acquisition can finally deliver value. All this is built upon Unity's unassailable market position as the dominant platform for the vast and growing world of mobile and independent game development.

The evidence suggests that the inflection point is real. Unity has successfully transitioned from a speculative, cash-burning growth story into a more tangible recovery play with a clear path to sustainable, profitable growth. The risks have not vanished, but the balance has shifted. The key for investors will be to monitor the company's ability to maintain its cost discipline while delivering the guided sequential growth in its Grow segment. If it can, this engine, now rebuilt and refocused, may be just beginning its next run.

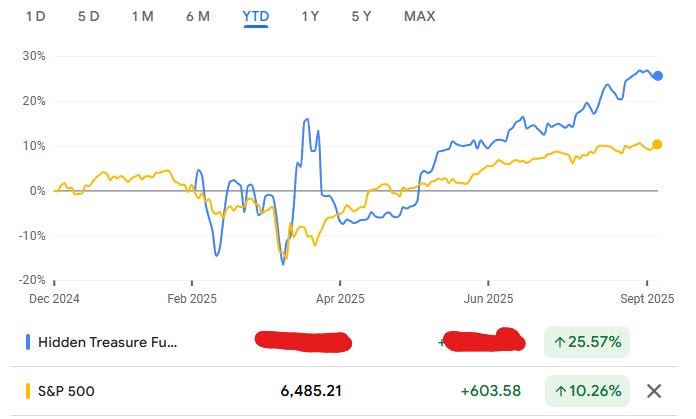

While Salesforce is interesting, it doesn't quite meet the stringent criteria for my Hidden Treasures portfolio, unlike NCR Atleos Corp, which is up 44% since I added it. Paid subscribers received the 1,800-word deep dive on why I believe it has another 100% to run.

The 'Hidden Treasures' Portfolio is the engine of my paid service. Since inception (6 months ago), it has returned 25.6% vs the S&P 500's 10.3%. Become a paid member to get access to all 11 holdings."

Thank you for reading, and have an amazing day!☺️